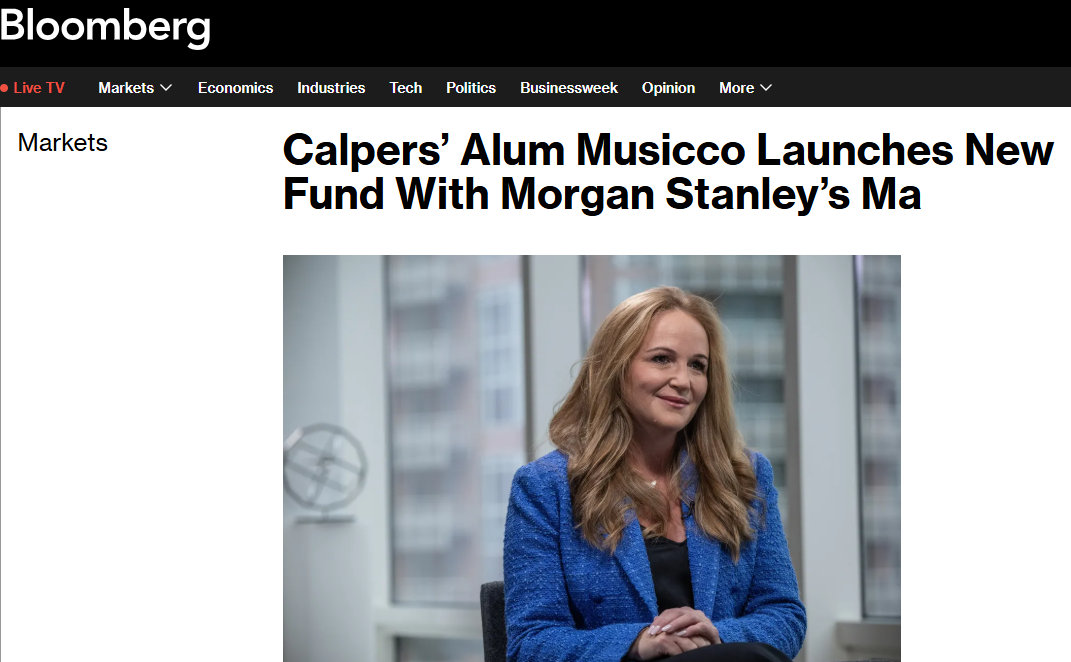

Bloomberg: Industry Veterans Nicole Musicco & Peter Ma Launch Square Nine Capital

Square Nine Capital is launching with serious firepower — led by Nicole Musicco and Peter Ma, bringing deep institutional roots to a $1B+ opportunistic credit play in the mid-market.

Nicole Musicco is resurfacing on Wall Street with a new credit venture after a surprising exit from California Public Employees’ Retirement System more than a year ago. Peter Ma of Morgan Stanley is set to join her.

The pair are looking to form a more than $1 billion platform, Square Nine Capital, that will focus on opportunistic lending to mid-sized companies, according to people with knowledge of the matter. Musicco and Ma will be joined by other executives from Morgan Stanley, said the people who asked not to be identified as the details are private, adding that it’ll launch in early June.

Musicco declined to comment, as did Ma and a Morgan Stanley representative.

The venture marks Musicco’s, return to credit markets after a brief 18-month stint as chief investment officer role at Calpers. Her departure made waves in the industry, as the largest pension fund in the US raced to hire a new CIO following several abrupt exits. Musicco spent more than 16 years at the Ontario Teachers’ Pension Plan and a year at the Investment Management Corporation of Ontario before joining RedBird Capital Partners, according to her LinkedIn profile.

She’ll be joined in her new venture by Ma, who has spent about four years with Morgan Stanley’s private credit platform and previously worked for almost a decade at Colbeck Capital Management, a private credit firm.

She’ll be joined in her new venture by Ma, who has spent about four years with Morgan Stanley’s private credit platform and previously worked for almost a decade at Colbeck Capital Management, a private credit firm.

The pair will be the latest to launch a credit venture at a time when borrowers are looking at ways to amend their debt or find creative financings. Earlier this month, former Ares Management Corp. partner Scott Graves launched Lane42 Investment Partners, focused on opportunistic investments by providing liquidity to firms across the spectrum. Paul Goldschmid, a former partner at King Street Capital Management, and Two Sigma alum David Cohen also debuted their new credit firm Harvey Capital Partners to invest in idiosyncratic investments.

LikeDiscussion

Share

Discussion

You are commenting on Bloomberg: Industry Veterans Nicole Musicco & Peter Ma Launch Square Nine Capital

You must be logged in to add a comment

There are no comments

Be the first to add to the discussion

Fund manager

Related news

Audax Private Equity Announces Sector Expansion and Senior Hires

Bridgepoint to Reinvest in Kyriba, Alongside New Minority Investor, General Atlantic

Schroders Capital bolsters Securitized Product & Asset-based Finance team with Investment Director

Blackstone Credit & Insurance Announces $1 Billion Forward Flow Origination Partnership with Harvest Commercial Capital

Goldman Sachs Alternatives Launches Climate Credit Strategy with $1bn in Initial Commitments

Goldman Sachs Alternatives Launches Climate Credit Strategy with $1bn in Initial Commitments

Blackstone Tactical Opportunities Hires Joseph Cassanelli as Senior Managing Director Focused on Financial Services Sector Investments

Carlyle and Citi to Collaborate on Asset-Backed Finance Opportunities in Fintech Specialty Lending