ASEAN PErspectives #7: Reframing the Emerging Market Alpha argument

In this PErspetive piece, we challenge the treatment of multiple expansion (MEME) as unlevered in private equity value creation. By reclassifying MEME as mostly leverage-driven, we show that Emerging Market Alpha (EMA) is more real than perceived—driven by fundamental, unlevered growth vs. debt-fueled returns in DMs.

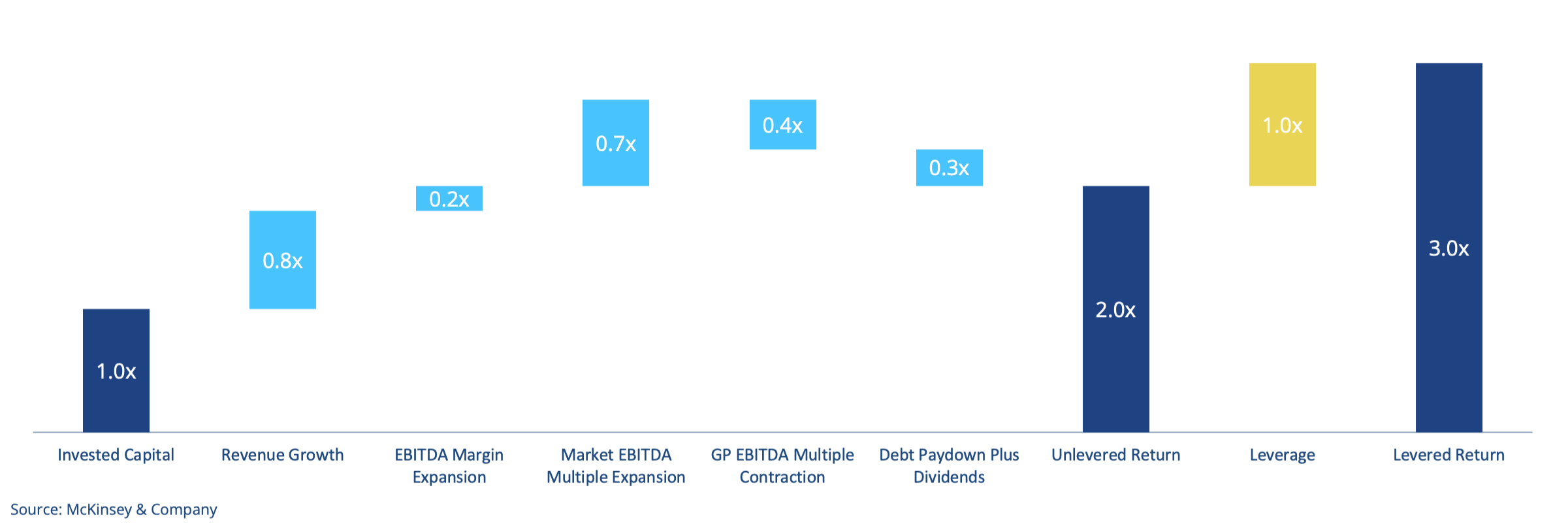

We wanted to modestly contribute to the debate and offer some perspective on the often promulgated “Emerging Market Alpha” (EMA), a frequently stated criterion supporting investing in Emerging Markets (EM) versus Developed Markets (DM), or indeed not. A recently released report from McKinsey & Company (McKinsey) on global private markets shared a relevant and clear private equity value creation walk graphic, which will be foundational to our argument and discussion.

According to McKinsey’s data sample analysis, realised private equity buyout deals between 2010 and 2022 generated a threefold return on invested capital, furthermore, the report proclaimed that “leverage and market multiple expansion drove 61% of investment returns”1. In the chart above, one can also easily conclude that half of the returns came from unlevered components, with the remaining half driven by leverage. For the purposes of our argument, we are neither questioning the data’s veracity nor the report’s cogent conclusions, rather challenging the value creation components’ classification as levered versus unlevered, particularly “Market EBITDA Multiple Expansion” (MEME).

According to McKinsey’s data sample analysis, realised private equity buyout deals between 2010 and 2022 generated a threefold return on invested capital, furthermore, the report proclaimed that “leverage and market multiple expansion drove 61% of investment returns”1. In the chart above, one can also easily conclude that half of the returns came from unlevered components, with the remaining half driven by leverage. For the purposes of our argument, we are neither questioning the data’s veracity nor the report’s cogent conclusions, rather challenging the value creation components’ classification as levered versus unlevered, particularly “Market EBITDA Multiple Expansion” (MEME).

Dissecting MEME and how it may in fact be partially influenced by leverage

Simplistically, multiple expansion occurs when the buyer of a company pays more than the seller did at entry, generally based on a multiple of the company’s Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA), which effectively sets the Enterprise’s Value (EV) at purchase. Buyers have a choice of financing this EV through a mix equity and debt, which logically influences multiple expansion constituents and drivers.

For instance, assuming all other parameters being equal, EBITDA in particular, a USD 200m EV transaction at entry may have been structured with 50% equity and 50% debt (50/50) by the seller then sold to the buyer for a USD 300m EV structured 33/67. This would generate a 2.0x return on the seller’s equity solely driven by a 1.0x MEME, hence, one would safely assume this expansion is entirely leverage driven. The opposite conclusion could indeed be drawn had the buyer structured its transaction 67/33, MEME would have been solely unlevered. The fact of the matter is that MEME is influenced by distinct market dynamics…

One is fundamentally market-led and unlevered. The increase in EV purchase multiple reflects favourable shifts in investor sentiment, macroeconomic conditions, and/or asset quality perceptions. This tends to correlate with genuine improvements in the business’ fundamentals and broader market optimism which drives belief that the company possesses strong growth potential and therefore is perceived as more valuable.

The other is leverage-driven and occurs when a buyer can simply take on more debt to fund a higher purchase price without additional equity. This may have less to do with improved business performance versus market pricing and/or availability of debt, which may have an inflationary influence on asset prices.

When looking at MEME in value creation walks such as in McKinsey’s report, we therefore hold the belief that MEME should really be fragmented and partially added to the levered return category, thus lowering the unlevered return component and increasing the levered one.

For instance, assuming all other parameters being equal, EBITDA in particular, a USD 200m EV transaction at entry may have been structured with 50% equity and 50% debt (50/50) by the seller then sold to the buyer for a USD 300m EV structured 33/67. This would generate a 2.0x return on the seller’s equity solely driven by a 1.0x MEME, hence, one would safely assume this expansion is entirely leverage driven. The opposite conclusion could indeed be drawn had the buyer structured its transaction 67/33, MEME would have been solely unlevered. The fact of the matter is that MEME is influenced by distinct market dynamics…

One is fundamentally market-led and unlevered. The increase in EV purchase multiple reflects favourable shifts in investor sentiment, macroeconomic conditions, and/or asset quality perceptions. This tends to correlate with genuine improvements in the business’ fundamentals and broader market optimism which drives belief that the company possesses strong growth potential and therefore is perceived as more valuable.

The other is leverage-driven and occurs when a buyer can simply take on more debt to fund a higher purchase price without additional equity. This may have less to do with improved business performance versus market pricing and/or availability of debt, which may have an inflationary influence on asset prices.

When looking at MEME in value creation walks such as in McKinsey’s report, we therefore hold the belief that MEME should really be fragmented and partially added to the levered return category, thus lowering the unlevered return component and increasing the levered one.

Assessing levered MEME and reevaluating DM unlevered return

McKinsey’s analysis is based on 3,000+ buyout deals entered and exited between 2010 and 2022, a period when cheap credit and generous leverage levels were increasingly available while private equity was experiencing historical growth levels. MEME was therefore supported by strong market tailwinds, and it is safe to assume that in a favourable monetary policy environment, MEME would lean towards being more leverage-driven. This hypothesis may be in part supported by analysis in McKinsey’s 2024 global private markets report which posted the same value creation walk as above with similar conclusions. The report shared additional data, which in summary, stated that for 2023 “global buyout entry multiples declined nearly one turn” and “US buyout leverage declined approximately one turn”. This may not be irrefutable evidence of a one-to-one correlation ratio between leverage levels and private equity transaction pricing but offers some indication that a strong one does exist. For the simple purpose of our argument, we have assumed a MEME at 25% unlevered and 75% levered, as such we reproduced and adjusted the same value creation walk.

Please see full article here to access the figure.

Through this MEME rebalancing exercise, we have therefore evaluated the unlevered returns to be 1.5x versus 2.0x previously, which enables us to put EMA into a more relevant context.

A changing market landscape where EMA may come in handy

Implications of a potentially tougher credit environment are increasingly difficult to ignore. Hugh MacArthur, Chairman of Bain & Company’s (Bain) Global Private Equity Group, recently outlined the extent to which evolving debt dynamics are recalibrating return expectations across the asset class.

His illustrative analysis, please see full article here to access the figure, shows that delivering a 20% Internal Rate of Return (IRR) at a 15x EV to EBITDA entry multiple previously required 10.5% annual EBITDA growth, enabled by the availability of 7x leverage to EBITDA at a 6% interest rate. This contrasts with current market conditions, where leverage contracted to 4.2x at an interest rate of 10.3%, therefore requiring 14.5% EBITDA growth to deliver the same return.

DM private equity funds are therefore increasingly compelled to deliver genuine operational value creation or, as MacArthur puts it, “dust off the full potential playbook and actually use it”, while operating in an anaemic macroeconomic context. In this context, EM fund performances deliver a more fundamental form of value creation, driven by growth and operational value add which is inherently more resilient. In ASEAN specifically, set against the backdrop of its strong macroeconomic growth fundamentals, private equity funds are well positioned to deliver strong operationally-driven unlevered returns.

This makes the case for EMA more compelling because it is important to point out that DM versus EM fund performance benchmarking may be slightly expedient when not carefully considering return drivers. This “apples to oranges” comparison has always put EMs at a disadvantage because for the same level of return, one was highly levered and the other not. Over the last decade, this may have indeed led DM allocators to overexpose their EM portfolios to venture capital in search of this elusive EMA, while in fact it was simply always there in more stable unlevered growth capital brick-and-mortar strategies.

In summary, EMs are not only a diversifier play but can also truly deliver the vaunted EMA allocators seek, it is simply a question of nuance and perspective on what returns are derived from. With less profligate credits markets for the foreseeable future, we are glad to be operating in a market where returns are nearly exclusively driven by operational growth.

4

1

1

LikeDiscussion

Share

Discussion

You are commenting on ASEAN PErspectives #7: Reframing the Emerging Market Alpha argument

You must be logged in to add a comment

There are no comments

Be the first to add to the discussion

Fund manager

Collyer Capital

Singapore, SingaporeCollyer Capital is an investment manager focused on delivering hybrid alternative investments solutions across Southeast Asia. Thanks to the team’s strong track record, we leverage our expertise and networks to drive compelling value by investing across sectors leveraging companies’ secular growth trends, technological innovation and/or operational transformation.

private equityfund of funds

Related news

Should VCs Scale? | El Pack w/ Screendoor | Superclusters

With More Companies Privately Owned, Capital and Operational Excellence will Define Private Equity Success

Capital Dynamics Clean Energy Achieves Top Rankings from GRESB in 2024 for Renewable Power

EQT to invest in PropertyMe, a leading Australian cloud-based PropTech company

Tikehau Capital raises €1 billion to support Egis’ next phase of growth, with backing from an Apollo S3 / ADIA consortium and Neuberger Berman as co-lead investors

GP-led secondaries - The New Frontier

Goldman Sachs Asset Management Expands Fixed Income ETF Range with Two Active High Yield Bond ETFs

Capital Dynamics Earns Top Scores in 2025 PRI Transparency Assessment