Equitix announces strategic partnership with TCorp to grow renewable energy platform in Spain

Equitix and TCorp form 50/50 partnership to expand Spain’s hybrid renewable energy platform, targeting 1.4 GW of capacity by 2030 and supporting the country’s net-zero goals

Equitix today announces its strategic partnership with the New South Wales Treasury Corporation (TCorp) to grow its renewable energy hybridisation platform in Spain. Through this 50/50 partnership, both parties will jointly fund a project pipeline to grow Equitix’s existing portfolio of hybrid renewable assets.

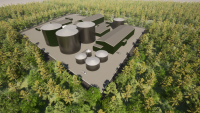

The current portfolio, acquired by Equitix in 2024, comprises 200 megawatts (MW) of operational and under-construction assets, along with an additional 150 MW in development. TCorp and Equitix are targeting 1.4 gigawatts (GW) of generational capacity by 2030 and have exclusivity over a 1 GW pipeline throughout Spain.

The term “hybridisation” refers to the integration of multiple renewable energy sources to create a more reliable, efficient and sustainable generation system. The complementary energy generation profiles of wind, solar and battery storage provide a supply of energy with baseload characteristics, maximising grid usage and protecting returns while improving grid resilience by reducing intermittency. Hybridised assets have other benefits such as cost synergies and a streamlined permitting process, especially in Spain where there is a favourable regulatory framework.

Renewable energy is central to Spain’s energy strategy which aims to increase renewable power capacity to 81% by 2030. Once fully developed, the hybridisation platform will increase Spain’s renewable energy supply, help it meet both domestic and European sustainability goals and generate enough electricity to power 900,000 households.

The current portfolio, acquired by Equitix in 2024, comprises 200 megawatts (MW) of operational and under-construction assets, along with an additional 150 MW in development. TCorp and Equitix are targeting 1.4 gigawatts (GW) of generational capacity by 2030 and have exclusivity over a 1 GW pipeline throughout Spain.

The term “hybridisation” refers to the integration of multiple renewable energy sources to create a more reliable, efficient and sustainable generation system. The complementary energy generation profiles of wind, solar and battery storage provide a supply of energy with baseload characteristics, maximising grid usage and protecting returns while improving grid resilience by reducing intermittency. Hybridised assets have other benefits such as cost synergies and a streamlined permitting process, especially in Spain where there is a favourable regulatory framework.

Renewable energy is central to Spain’s energy strategy which aims to increase renewable power capacity to 81% by 2030. Once fully developed, the hybridisation platform will increase Spain’s renewable energy supply, help it meet both domestic and European sustainability goals and generate enough electricity to power 900,000 households.

Achal Bhuwania, Equitix Chief Investment Officer, said: “Our partnership with TCorp is of great significance to Equitix and we are delighted to welcome them into our hybridisation platform. This is a significant vote of confidence in our ability to source high-quality renewable energy assets in Europe and further evidence of our ability to attract leading global investors. Our experience as a major investor in renewable energy and energy storage, complemented by our dedicated team in Spain was pivotal to our success in securing this strategic partnership.”

TCorp Chief Investment Officer Stewart Brentnall said: “This investment provides a great opportunity to invest in a renewable energy business with a strong competitive position and deepen our partnership with Equitix, a leading renewable energy manager. This investment will expand and diversify TCorp’s global infrastructure portfolio and position it to capture positive and sustainable returns in the clean energy sector.”

Equitix was advised by Ashurst (Legal), EY (Modelling, Tax & Structuring), DNV (Technical) and Baringa (Sustainability).

TCorp was advised by Linklaters (Legal) and KPMG (Tax & Structuring).

About Equitix

Established in 2007, Equitix is a leading European mid-market infrastructure fund manager with $15 billion under management. Equitix has invested in more than 300 assets in 24 countries across diversified sectors including renewables, transmission, and distribution, social infrastructure, transportation infrastructure, environmental services, and digital infrastructure.

Equitix has been active in Spain since 2018 where it owns, builds, and manages key infrastructure assets. Notable projects include Telecom Castilla La Mancha, Barcelona Metro Line 9, the Llobregat Courts of Justice, a portfolio of smart meters, and a sizeable renewable energy portfolio in addition to its hybridisation platform.

www.equitix.com

Media: equitix@teneo.com

About TCorp

TCorp is sovereign investor for the state of New South Wales in Australia, providing investment management, financial management solutions and advice. The investment management business is responsible for AUD 118 billion of assets under management. It has partnered with Equitix since December 2023 when it acquired a stake in energy from waste business Viridor.

tcorp.nsw.gov.au

LikeDiscussion

Share

Discussion

You are commenting on Equitix announces strategic partnership with TCorp to grow renewable energy platform in Spain

You must be logged in to add a comment

There are no comments

Be the first to add to the discussion

Fund manager

Equitix

London, United KingdomWe are a responsible investor, investing in, developing and managing global infrastructure assets, which materially contribute to the lives of the communities they serve.

We employ over 200 professionals across 15 locations, managing over 360 assets in over 20 countries globally, with a current AUM of $12bn.

infrastructure

Related news

Equitix acquires additional UK onshore wind portfolio

Equitix acquires subsea energy interconnector linking Great Britain and Ireland

Equitix completes acquisition of German offshore windfarm, Gode Wind 1

Equitix-led consortium with Aware Super and the National Wealth Fund launches a £500 million platform to build, own, and operate UK battery storage assets

Repsol partners with Schroders Greencoat in a 400 MW Spanish renewable portfolio valued at €580 million

Capital Dynamics Acquires c.317MWp of Solar PV Portfolios in Spain and Enters PPA Agreements with a Large Corporate Buyer of Renewable Energy

NORD/LB delivers ca. €110m for three Capital Dynamics solar PV farms currently under construction in Spain

ElectroRoute and Low Carbon announce balancing PPAs for 140 MW of UK solar projects