Hamburg Green Hydrogen Hub awards contract for 100 MW electrolyzer to Siemens Energy

CfD Auction Success

Rapid Capital Deployment Delivers Continued Growth

Convexity becomes part of the Luxcara Group

Federal Minister for Economic Affairs and Climate Protection Robert Habeck visits IPCEI-funded projects: HGHH large-scale electrolyzer and HH-WIN hydrogen industrial network

Luxcara wins 1.5 GW North Sea site in Germany’s offshore wind auction based primarily on qualitative criteria

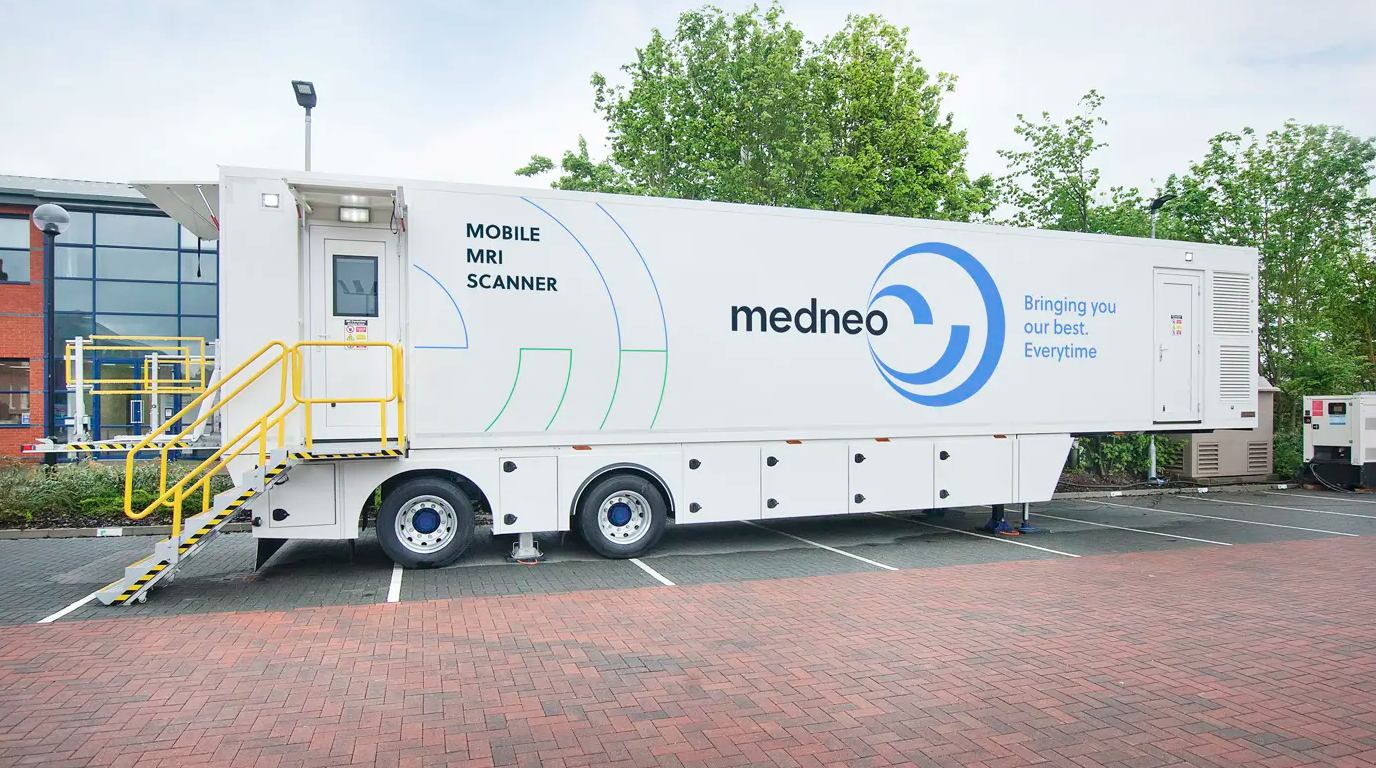

CVC DIF agrees to acquire diagnostic imaging business medneo UK

Antin Infrastructure Partners, ICAMAP and Borletti Group to sell Grandi Stazioni Retail to a consortium of infrastructure investors comprising DWS and OMERS

Excelsior Energy Capital Enters Multiyear, 2.2 GWh Agreement with Fluence to Utilize Domestically Manufactured Battery Cells in US Energy Storage Projects

CVC DIF

Schiphol, NetherlandsCVC DIF (formerly DIF Capital Partners) is a leading global mid-market infrastructure equity fund manager.

Founded in 2005 and headquartered in Amsterdam, the Netherlands, CVC DIF has c. €18 billion of infrastructure assets under management in energy transition, transport, utilities and digitalisation.

With over 240 people in 12 offices, CVC DIF offers a unique market approach, combining a global presence with the benefits of strong local networks and sector-focused investment capabilities.

CVC DIF forms the infrastructure strategy of leading global private markets manager CVC. This partnership allows CVC DIF to benefit from CVC’s global platform, with 30 offices across five continents.

infrastructure

Luxcara

Hamburg, GermanyLuxcara is an independent asset manager offering institutional investors equity and debt investment opportunities in clean infrastructure. Luxcara acquires, structures, finances and operates clean infrastructure portfolios.

The owner-managed company was founded in 2009 by two women and has since valued its team diversity. Based in Hamburg, a highly qualified team of specialists manages a portfolio of clean infrastructure projects, such as solar plants, on- and offshore wind farms, ev charging stations, hydrogen power plants and many more, in Europe with a total capacity of around 6 gigawatts and an investment volume of about 6 billion euros.

infrastructure

NextEnergy Capital

London, United KingdomNextEnergy Capital was founded in 2007 to become the leading specialist investment and asset manager in the solar sector.

Our mission is to generate a more sustainable future by leading the transition to clean energy.

We manage multiple private and public investment platforms and are the leading global operating asset manager of solar power projects.

infrastructure

Antin Infrastructure Partners

Paris, FranceAntin Infrastructure Partners is a leading private equity firm focused on infrastructure. With over €32bn in Assets under Management, Antin targets majority stakes in the energy and environment, digital, transport and social infrastructure sectors. Based in Paris, London, New York, Singapore and Luxembourg, Antin employs over 240 professionals dedicated to growing, improving and transforming infrastructure businesses while delivering long-term value to investors and portfolio companies. Majority owned by its partners, Antin is listed on compartment A of the regulated market of Euronext Paris (Ticker: ANTIN – ISIN: FR0014005AL0)

We look for companies with potential for operational improvements and active capital management. We undertake rigorous due diligence, focusing on business fundamentals, industry and market dynamics, and then prioritise business planning and transaction management.

Antin invests in infrastructure businesses in Europe and North America across the energy and environment, digital, transport and social sectors. We employ a hands-on investment strategy focused on value creation and downside protection.

We manage funds across three strategies: Flagship, Mid Cap, NextGen

infrastructuregrowth

Excelsior Energy Capital

Excelsior, United StatesExcelsior Energy Capital is a pure-play renewable energy infrastructure fund focused on long-term investments in operating wind, solar power plants, and battery storage in North America. The Excelsior Energy Capital team has a proven track record, as a group executing over $2.5 billion of equity investments across 2 GW of operating wind and solar projects. The team brings a comprehensive set of financial, legal, strategic and operational expertise – making Excelsior Energy Capital a valuable partner for developers and operators, and a trusted manager for investors.

Wind, solar, and battery storage is at last an established asset class. Technology efficiencies and installed costs have evolved to a point where wind and solar plants can compete with conventional generation such as natural gas and coal. Long-term federal tax policy and increasing state-level renewable portfolio standards are further supporting industry growth. As a result, installed capacity is expected to double as U.S. solar and wind project installations are forecasted to grow by over 120 GW by 2021 according to Bloomberg New Energy Finance. There is now extensive inventory of attractive assets presenting stable investments for institutional investors.

infrastructure