Equitix strengthens position in Italy’s solar market by increasing its stake in joint venture with ACEA

Low Carbon signs two 15-year route-to-market PPAs with SSE Energy Markets

Heelstone Renewable Energy, a Qualitas Energy company, secures a $200 million senior corporate credit facility

Brookfield Renewable to Issue C$500 Million of Green Bonds

Qualitas Energy acquires 91 MW wind energy portfolio in Germany from PNE AG

Apollo Backs $5.4 Billion Valor and xAI Data Center Compute Infrastructure Transaction with $3.5 Billion Capital Solution

I Squared Capital Acquires Ramudden Global, a Leader in Traffic Management and Infrastructure Safety

EQT to acquire A-Train, operator of Arlanda express – the high-speed rail link connecting Stockholm with Arlanda Airport

I Squared Capital Accelerates U.S. Energy Transition with Acquisition of Oregon’s Premier Renewable Fuels Terminal

Equitix

London, United KingdomWe are a responsible investor, investing in, developing and managing global infrastructure assets, which materially contribute to the lives of the communities they serve.

We employ over 200 professionals across 15 locations, managing over 360 assets in over 20 countries globally, with a current AUM of $12bn.

infrastructure

Low Carbon

London, United KingdomLow Carbon creates renewable energy to fight climate change. We’re building a global net-zero energy company that will power tomorrow and protect the planet for future generations.

Low Carbon was established in 2011 with one goal in mind: to make the biggest contribution possible in the fight against climate change. The aim is to make a defining contribution to the historic effort to move the world to 100% renewable energy.

Low Carbon are a long-standing certified B-Corporation, and recognized as Gold Standard for their environmental impact. Low Carbon’s climate ambitions are to become one of the world’s first major net-zero energy companies and to have created 20GW of new renewable energy capacity by 2030.

Low Carbon is on a mission. Together, we will power tomorrow.

infrastructure

Qualitas Energy

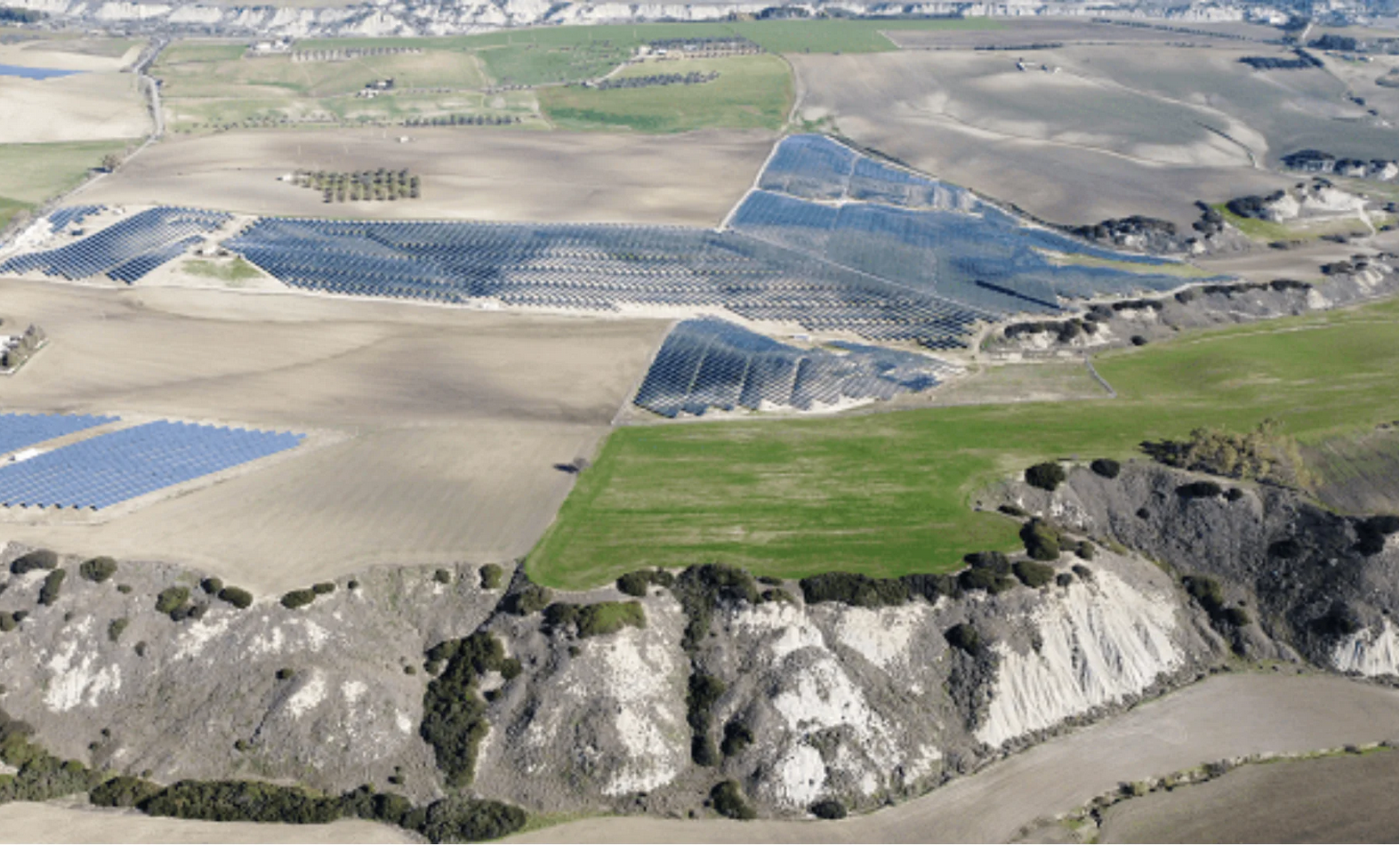

Madrid, SpainQualitas Energy is a leading investment and management platform focused on renewable energy, energy transition, and sustainable infrastructure investment. Since 2006, the Qualitas Energy team has dedicated more than €12 billion to the energy transition worldwide. These investments have been deployed through five vehicles: Fotowatio / FRV, Vela Energy, Qualitas Energy III, Qualitas Energy IV, and Qualitas Energy V. Qualitas Energy’s existing portfolio currently holds 11 GW of operating and development energy assets, across Spain, Germany, the UK, Italy, Poland, Chile, and the US. Since 2020, Qualitas Energy has produced sufficient energy to power 1.54 million homes and, since 2021, has successfully avoided emissions of 1.32 million metric tons of CO2 equivalent. The Qualitas Energy team is composed of more than 540 professionals across fifteen offices in Madrid, Berlin, London, Milan, Hamburg, Wiesbaden, Trier, Cologne, Stuttgart, Warsaw, Wroclaw, Santiago, Durham, Bristol, and Edinburgh.

infrastructureprivate debt

Brookfield Asset Management

Toronto, CanadaBrookfield is invested in long-life, high-quality assets and businesses around the world that form the backbone of the global economy. With over $925 billion in assets under management, and over 100 years’ experience as an owner and operator, we put our own capital to work in virtually every transaction, aligning interests with our partners and investors, and bringing the strengths of our operational expertise, global reach and large-scale capital to bear in everything we do.

buyoutprivate equityinfrastructurereal estate

Apollo Global Management

New York, United StatesApollo is a high-growth, global alternative asset manager. In our asset management business, we seek to provide our clients excess return at every point along the risk-reward spectrum from investment grade credit to private equity. For more than three decades, our investing expertise across our fully integrated platform has served the financial return needs of our clients and provided businesses with innovative capital solutions for growth. Through Athene, our retirement services business, we specialize in helping clients achieve financial security by providing a suite of retirement savings products and acting as a solutions provider to institutions. Our patient, creative, and knowledgeable approach to investing aligns our clients, businesses we invest in, our employees, and the communities we impact, to expand opportunity and achieve positive outcomes.

buyoutprivate equityinfrastructure

I Squared Capital

Miami, United StatesI Squared Capital is a leading independent global infrastructure manager with over $40 billion in assets under management focused on investing in North America, Europe, Asia, and Latin America. The firm is headquartered in Miami and has more than 280 professionals across its offices in Abu Dhabi, London, Munich, New Delhi, São Paulo, Singapore, Sydney, and Taipei.

infrastructureprivate debt