Quinbrook Infrastructure Partners

$4.80B AUM

infrastructure

Quinbrook Infrastructure Partners (‘Quinbrook’) is a specialist investment manager focused exclusively on the infrastructure needed to drive the energy transition in the UK, US, and Australia.

Quinbrook is led and managed by a senior team of power industry professionals who have collectively invested c. USD 6.9 billion of equity capital in 40 GW of energy infrastructure assets representing a total transaction value of USD 29.8 billion.

Quinbrook's investment and asset management team has offices in New York, Houston, London and Brisbane.

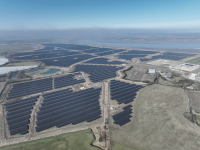

Quinbrook has completed a diverse range of direct investments in both utility and distributed scale onshore wind and solar power, battery storage, reserve peaking capacity, biomass, fugitive methane recovery, hydro and flexible energy management solutions in the UK, US, and Australia. Quinbrook is currently developing and constructing some of the largest renewables and storage infrastructure projects in the UK, US, and Australia.

Manager news

Quinbrook Fully Contracts ‘Supernode’ Battery Storage Project

Quinbrook Closes UK’s Largest Solar PV + Battery Storage Project Financing for Cleve Hill Solar Park

Quinbrook to Build Advanced Long Duration Battery Storage in Australia

Quinbrook Awarded Global Energy Transition Investor of the Year by Infrastructure Investor

Quinbrook to Construct Second Nationally Significant Infrastructure Project in Solar Power in East Midlands

Quinbrook Closes AUD$722 million debt financing for landmark Supernode battery storage project

Supernode stages 1 and 2 believed to be the largest battery storage financing in Australia to date.

Quinbrook to invest up to £100m in Aegis Energy to lead the deployment of clean, multi-energy refuelling hubs for commercial vehicles in the UK

Quinbrook’s First Synchronous Condenser in Scotland Now Built and Operating

Strategies

InfrastructureInfrastructure

A thoughtful, focused and differentiated investment strategy targeting opportunities arising from the Net Zero transition. Our strategy is three-pronged: pursuit of value-add returns from building development and construction stage projects into scaled thematic platforms featuring diversified operating revenues; growth opportunities via strategic industry partnerships and opportunistic acquisitions in emissions intensive industrial sectors; and the application of technological innovation to optimise asset performance. We pursue a targeted, sectoral approach that seeks to couple renewables supply projects with high growth, energy intensive industries seeking to rapidly decarbonize. Moreover, our strategy seeks to directly address the growing investment risk posed by power price volatility and market uncertainty by securing long-term purchase commitments from credit worthy corporate, utility and industrial customers. We believe the end result of successful execution will be value creation for our investors.

Energy Transition

Other managers

Energy Infrastructure Partners

Zurich, SwitzerlandA leading investor in the global energy transition, Energy Infrastructure Partners manages assets for institutional investors. With more than a decade of experience and three fund generations, we offer investors long-term returns and the chance to make tangible contributions to the energy transition through private equity investments.

infrastructure

Antin Infrastructure Partners

Paris, FranceAntin Infrastructure Partners is a leading private equity firm focused on infrastructure. With over €32bn in Assets under Management, Antin targets majority stakes in the energy and environment, digital, transport and social infrastructure sectors. Based in Paris, London, New York, Singapore and Luxembourg, Antin employs over 240 professionals dedicated to growing, improving and transforming infrastructure businesses while delivering long-term value to investors and portfolio companies. Majority owned by its partners, Antin is listed on compartment A of the regulated market of Euronext Paris (Ticker: ANTIN – ISIN: FR0014005AL0)

We look for companies with potential for operational improvements and active capital management. We undertake rigorous due diligence, focusing on business fundamentals, industry and market dynamics, and then prioritise business planning and transaction management.

Antin invests in infrastructure businesses in Europe and North America across the energy and environment, digital, transport and social sectors. We employ a hands-on investment strategy focused on value creation and downside protection.

We manage funds across three strategies: Flagship, Mid Cap, NextGen

infrastructuregrowth

Zouk Capital

London, United KingdomZouk Capital is a fund manager focused on the opportunities emerging at the intersection of infrastructure, technology and sustainability.

Our Infrastructure track focuses on investing in, building, and scaling projects and companies in environmental infrastructure and renewable energy. Focus areas include electric vehicle charging infrastructure, waste-to-energy, energy efficiency, and distributed small-scale energy, primarily in Europe and the UK.

Our Technology track helps commercially proven, technology-enabled companies to accelerate their growth, increase market share, and create value while delivering scalable environmental and social impact in the process. Focus areas include cleantech, mobility solutions, and impact-oriented fintech in Europe, the US, and Africa.

Based in London, Zouk manages approximately €1billion.

infrastructure

B Capital Partners

Zurich, SwitzerlandB Capital Partners AG is a partner-owned investment house, established in 2003 and Zurich-based. We exclusively focus on core sustainable infrastructure. Since 2010, we have invested and advised capital in excess of EUR 2.6bn across Europe. Our goal is to select superior infrastructure assets for our clients, while adhering to the highest corporate ethic as well as to state-of-the-art ESG standards. We are a signatory to UN PRI as well as to WEPs (Women Empowerment Principles) and a member of GRESB.

Based on the broad backgrounds and profound experience of its partners, B CAPITAL PARTNERS provides its clients with a thorough knowledge of the markets, professional strategic portfolio planning and construction, as well as a structured and thoughtful due diligence process with particular focus on risk assessment to evaluate both direct investment opportunities and fund managers. Systematic investment monitoring, controlling and reporting are naturally also part of its services.

infrastructure

Pioneer Point Partners

London, United KingdomEstablished in 2008, Pioneer is an independent, sustainable infrastructure investment firm. Led by our four founding partners with 90 years’ collective experience, we have grown to become a well-rounded institutional team, supported by industry advisors.

With deep sector specialisation, Pioneer focusses on the energy transition and environment sectors across Europe, where we see fundamental growth opportunities. We specifically target the lower mid-market, value-add segment and we take pride in our ability to consistently identify and source opportunities ahead of others.

Our approach to proactive deal origination and active asset management, underpinned by sustainability, helps us to deliver attractive returns to our investors.

infrastructure

Sandbrook Capital

Stamford, Connecticut, United StatesWe are a private investment firm dedicated exclusively to building businesses that help transform the world’s energy infrastructure. By partnering with courageous entrepreneurs that share our drive to fight climate change, we create impactful companies that move us closer to a net-zero world and deliver strong returns for our investors.

Our founders have each accumulated decades of experience operating, funding, and supporting climate infrastructure companies. They have worked together for over 14 years to formulate and refine a shared investment philosophy that has supported the growth of industry leaders such as Pattern Energy, Enviva Biomass, Silver Ridge Power, and SeaJacks Ltd. In 2021, this partnership evolved into Sandbrook Capital – a firm built from the ground up to help exceptional entrepreneurs tackle the greatest challenge of our time.

infrastructure

Copenhagen Infrastructure Partners

Copenhagen O, DenmarkCIP is a global, multi-strategy fund manager specialising in renewable energy infrastructure investments and is among the largest fund managers globally within renewables with 12 funds raised to date and approximately EUR 28 billion in aggregate commitments to date.

infrastructure

Wellington Partners

Munich, GermanyWellington Partners is one of the most successful pan-European venture capital firms. With funds totalling over € 800 million, we have invested throughout Europe in companies that have the potential to become real market leaders for more than 15 years.

We are committed to providing outstanding entrepreneurs with the necessary resources to fund their strategies. We typically lead financing rounds ranging from € 0.5 million to € 20 million. Depending on the maturity of the company, our own commitment can go as high as € 15 million.

Providing funding is only one part of our business. After funding, the entrepreneurs we back have access to the advice and guidance of our complete team and our entire global network. Our investment professionals operate out of four offices, located in London, Munich, Zurich and Palo Alto. The pan-European and transatlantic makeup of our organisation enables us to support our portfolio in expanding globally.

To date, Wellington Partners has invested in more than 100 companies throughout Europe. We have been a part of great successes as well as dismal failures. In our view, success has always been the result of a great idea executed by a great team with strong leadership and commitment; plus an enormous amount of hard work and an ounce of luck, the good fortune to be in the right place at right time.

private equityvc

Schroders Greencoat LLP

London, United KingdomSchroders Greencoat is a specialist investment manager dedicated to renewable infrastructure, with over £8.5 billion under management. We aim to provide strong risk-adjusted returns for our investors, while also delivering positive environmental outcomes.

Founded in 2009, Schroders Greencoat has built a reputation for unwavering delivery of our investment propositions, as well as for innovation – our offerings have become the model for an entire industry sector. Our investments span the globe, with local expertise in the Europe, the UK and the US, and are managed across a range of publicly listed vehicles*, private market pooled funds, co-investment vehicles and Separate Managed Accounts.

Renewable infrastructure is a multi-trillion dollar global sector that will grow by more than $100 billion a year over the next decade. Utilities, energy companies and infrastructure developers will build out the majority of this transition, but the scale of capital involved will require significant private financing. There exists a very large and growing pool of capital which is keen to own and operate these assets, but lacks the inhouse technical skills and sector expertise to manage the investments independently. Our purpose is to bridge this gap, by acting as a solution provider for investors, and providing the partnership, financial, technical and operational expertise to deliver secure incomes for our clients.

Acquired by Schroders plc in 2022, Schroders Greencoat is the fourth pillar of the group's private markets investment business, Schroders Capital. Schroders Capital through Schroders Greencoat has the ambition to become a global leader in infrastructure and the alternative investment industry more broadly.

* Schroders Greencoat is the investment manager for two listed vehicles, Greencoat UK Wind PLC and Greencoat Renewables PLC.

infrastructure

Goodyields Capital

Munich, Bavaria, GermanyGoodyields Capital provides institutional investors with access to attractive investment opportunities in energy infrastructure through its strong industry partner network. This asset class particularly meets the demands of institutional investors. We offer ambitious, conservative and long-term investors tailor-made solutions with attractive returns and yields.

Goodyields Capital was founded to entirely focus on the energy infrastructure asset class. The firm successfully manages its Renewable Energy Infrastructure Funds with a European mandate and direct investment transactions globally with the mission to deliver predictable, stable returns for institutional investors.

Goodyields today is an established player in the energy infrastructure sector comprising more than 50 years of combined professional power market and energy financing experience.

infrastructure