Actis bolsters its Indian renewables footprint through acquisition of Stride’s 371MW portfolio

On March 24, 2025, Actis announced the acquisition of a 100% stake in Stride Climate Investments (“Stride”), a solar generation asset portfolio in India, from a fund managed by Macquarie Asset Management.

LUXEMBOURG, 24 March 2025: Actis, a leading global investor in sustainable infrastructure, has acquired a 100% stake in Stride Climate Investments (“Stride”), a solar generation asset portfolio in India, from a fund managed by Macquarie Asset Management.

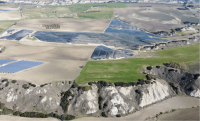

The deal sees Actis take charge of Stride’s 371MW (414MWp) portfolio of operating solar PV assets spread across 21 projects in 7 states, the majority of which are concentrated in the state of Gujarat. The Stride portfolio, which has close to a decade of demonstrated track record, features long-term pay-as-produce power purchase agreements with a diversified pool of off-takers, from central and state governments as well as the private sector, and a distributed asset base.

Actis has deployed more than US$7.1 billion in Asia since inception across different strategies and, as a leading energy investor, has built or operated more than 8GW of installed capacity in the region, including more than 5.5GW of renewables.

With this acquisition, Stride joins BluPine Energy and Athena Renewables to become Actis’ third current energy generation platform in India.

The deal sees Actis take charge of Stride’s 371MW (414MWp) portfolio of operating solar PV assets spread across 21 projects in 7 states, the majority of which are concentrated in the state of Gujarat. The Stride portfolio, which has close to a decade of demonstrated track record, features long-term pay-as-produce power purchase agreements with a diversified pool of off-takers, from central and state governments as well as the private sector, and a distributed asset base.

Actis has deployed more than US$7.1 billion in Asia since inception across different strategies and, as a leading energy investor, has built or operated more than 8GW of installed capacity in the region, including more than 5.5GW of renewables.

With this acquisition, Stride joins BluPine Energy and Athena Renewables to become Actis’ third current energy generation platform in India.

Adrian Mucalov, Partner, Head of Long Life Infrastructure at Actis, said: “The acquisition of Stride aligns nicely with Actis’ long life infrastructure investment approach. The business has a 10-year operating history, compelling cash generation and low existing leverage. We believe Stride offers strong prospects to deliver cash yields to investors while also being in a dynamic, rapidly growing market.”

Abhishek Bansal, Partner, Energy Infrastructure at Actis, commented: “Actis has a long experience of successful investment in the Indian renewable energy sector, exemplified by Ostro Energy and Sprng Energy previously as well as by our current renewables platforms. The Indian economy is continuing to grow rapidly and its energy transition is accelerating apace, with the government aiming to secure 50 percent of the country’s electricity from renewables by 2030. This environment is therefore creating ample opportunities, especially for an investor such as Actis with expertise in driving efficiency and creating value in this market.”

ENDS

LikeDiscussion

Share

Discussion

You are commenting on Actis bolsters its Indian renewables footprint through acquisition of Stride’s 371MW portfolio

You must be logged in to add a comment

There are no comments

Be the first to add to the discussion

Fund manager

Actis

London, United KingdomActis is a leading global investor in sustainable infrastructure.

Actis targets consistent superior returns across asset classes over the long-term, bringing financial and social benefits to investors, consumers and communities. We believe values drive value.

Actis is a leading global investor in sustainable infrastructure.

We deliver competitive returns for institutional investors and measurable positive impact for countries, cities, and communities in which we operate. Our global experience, operational know-how and strong culture allow us to create global sustainability leaders. We do it at scale. And have been doing so for decades. Since inception, we have raised circa US$25 billion to invest in a better tomorrow.

In October 2024, Actis joined forces with General Atlantic, a leading global growth investor, creating a diversified, global investment platform with approximately $87 billion in combined assets under management. Actis operates as General Atlantic’s sustainable infrastructure business. This strategic combination further enhances Actis’ focus as a leader in global sustainable infrastructure.

buyoutprivate equityinfrastructurereal estate

Related news

Actis raises US$1.7 billion for second long life infrastructure fund

Actis to acquire a portfolio of operational hybrid annuity model road assets in India

Actis closes US$600 million MTerra Solar investment with Meralco PowerGEN (MGEN) unit MGreen

EDF India and Actis announce strategic partnership to develop advanced metering infrastructure in India

Copenhagen Infrastructure Partners and AMPIN Energy Transition expand partnership in India

Hong Kong monetary authority anchors actis’ Asia climate strategy to support decarbonisation in Asia

Qualitas Energy welcomes €200 million in commitments for its new Credit strategy, currently targeting investments of €500 million

Qualitas Energy and Mirova unite to power Italy’s energy transition through a 250 MW renewables platform