Federation Asset Management to launch energy storage platform to drive Australia’s energy future

Federation Asset Management announces plans to launch a new long-duration energy storage platform to strengthen Australia’s energy security and lower electricity costs.

31 March 2025: Federation Asset Management (“Federation”), one of Australia’s leading private markets investment firms, has announced its intention to launch a new long-duration energy storage platform designed to enhance the country’s energy security and lower energy costs.

Federation sees significant investment potential in Australia’s energy storage market, citing strong risk-adjusted returns and the increasing need for grid stability.

Federation sees significant investment potential in Australia’s energy storage market, citing strong risk-adjusted returns and the increasing need for grid stability.

“Energy storage is a large-scale investment opportunity with attractive risk-return characteristics,” said Stephen Panizza, Partner at Federation Asset Management.

The primary role of energy storage is to stabilise supply, shifting energy from periods of excess production to times of peak demand. As Australia continues to expand its renewable energy capacity,

particularly solar, storage solutions are critical to ensuring a reliable and cost-effective electricity grid.

Battery Energy Storage Systems (BESS) offer an efficient solution to both grid stability and surplus energy storage. Federation estimates that this sector represents an investment opportunity exceeding $100 billion.

“Significant investment in infrastructure, technological advancements to improve storage efficiency, and coordination of storage systems are essential to meeting the growing demand for renewable

energy,” he said.

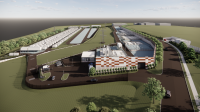

Federation was an early investor in BESS, with its investment in the Riverina Battery Energy Storage System serving as a prime example. The 150 MW / 300 MWh facility has enough storage capacity to power a city the size of Canberra for two hours while stabilising the electricity grid in southwest New South Wales. The project generates revenue from Transgrid for solving long-standing grid instability issues, alongside long-term contracts with electricity generators and retailers.

“BESS is proving to be an excellent asset class - multiple revenue sources, low construction risks, minimal environmental impact, and low operating costs - all while playing a critical role in energy security,” said Panizza.

“To support continued growth in solar generation, lower energy costs, stabilise the grid and enable the retirement of aging coal plants, large-scale investment in BESS is essential. Federation is committed to leading the way and to remain at the forefront of Australia’s energy storage sector.”

Ends

Media contact

Simrita Virk, Capital Outcomes

simrita@capitaloutcomes.co

About Federation

Federation invests in businesses that meet economic and social needs, across social Infrastructure, private equity and real estate with particular strengths in renewable energy, health and education

real estate and businesses servicing an aging population and modernising world. The firm manages capital commitments of more than $2 billion for institutional and individual investors.

For more information please visit: https://www.federationam.com/

LikeDiscussion

Share

Discussion

You are commenting on Federation Asset Management to launch energy storage platform to drive Australia’s energy future

You must be logged in to add a comment

There are no comments

Be the first to add to the discussion

Fund manager

Related news

Quinbrook Closes AUD$722 million debt financing for landmark Supernode battery storage project

Supernode stages 1 and 2 believed to be the largest battery storage financing in Australia to date.

Equitix-led consortium with Aware Super and the National Wealth Fund launches a £500 million platform to build, own, and operate UK battery storage assets

CVC DIF agrees the sale of 1GW+ portfolio of renewable energy projects to Potentia Energy

Quinbrook Fully Contracts ‘Supernode’ Battery Storage Project

Preferred Equity Pioneer Captona Announces Transaction for 1 GWh Energy Storage Portfolio in Texas

Revera Launches as Independent Energy Infrastructure Platform Backed by Carlyle

Excelsior Energy Capital Enters Multiyear, 2.2 GWh Agreement with Fluence to Utilize Domestically Manufactured Battery Cells in US Energy Storage Projects