Green Utility acquires Mareccio Energia, a portfolio of solar PV in Italy

Green Utility has entered into a binding agreement to acquire Mareccio Energia, a portfolio of solar PV in Italy, marking a rapid take-off in its growth strategy.

Paris/Rome, August 01, 2025 - Green Utility, a solar PV platform focused on distributed generation and self-consumption solutions for Commercial and Industrial (C&I) clients in Italy, has entered into a binding agreement with Basalt Infrastructure Partners to acquire Mareccio Energia, a portfolio of solar-PV in Italy.

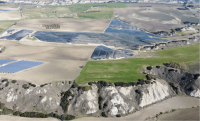

The transaction includes a fully operational solar PV portfolio of 61 MW across 66 plants, primarily located in Puglia, Umbria, and Sicily. The Mareccio Energia assets offer a diversified geographical

footprint that complements Green Utility’s existing portfolio. Plans are already in place to revamp and repower parts of the portfolio to further increase its capacity and performance.

This acquisition marks a first step forward in Green Utility’s expansion roadmap. With InfraVia as the majority shareholder since the end of 2024, Green Utility is on track to triple the size of its platform from an initial portfolio of c.50MW to more than 170MW within one year, leveraging both organic growth and acquisitions.

InfraVia and Green Utility aim to capitalize on the company’s proven expertise in project development, construction, and operations to establish a leading position in Italy’s distributed solar PV market.

The transaction includes a fully operational solar PV portfolio of 61 MW across 66 plants, primarily located in Puglia, Umbria, and Sicily. The Mareccio Energia assets offer a diversified geographical

footprint that complements Green Utility’s existing portfolio. Plans are already in place to revamp and repower parts of the portfolio to further increase its capacity and performance.

This acquisition marks a first step forward in Green Utility’s expansion roadmap. With InfraVia as the majority shareholder since the end of 2024, Green Utility is on track to triple the size of its platform from an initial portfolio of c.50MW to more than 170MW within one year, leveraging both organic growth and acquisitions.

InfraVia and Green Utility aim to capitalize on the company’s proven expertise in project development, construction, and operations to establish a leading position in Italy’s distributed solar PV market.

Silvio Gentile, CEO and Founder of Green Utility, said:

“This acquisition represents a significant acceleration of Green Utility’s strategic ambitions. Our goal is to become a leading partner for self-consumption and energy efficiency solutions in the C&I segment, combining behind-the-meter installations with stand-alone generation capacity sold directly to end users. We already serve several high-profile clients in Italy’s industrial sector and are focused on developing distributed assets located close to consumption centers. By expanding our asset base and geographic reach, we aim to offer a fully integrated consumption model tailored to the evolving needs of our C&I clients.”

John Hanna, Managing Partner, Basalt Infrastructure Partners, said:

“It has been a great experience to build and manage the Mareccio Energia portfolio through our ownership and we have enjoyed working alongside Green Utility to deliver this transaction. We wish them success in the next phase of development”.

Lazard acted as sole financial advisor to Green Utility while ValeCap acted as sole financial advisor to Basalt Infrastructure Partners.

The terms and conditions of the contemplated transaction are not disclosed, and closing is envisaged in September 2025.

MEDIA CONTACTS

Green Utility

Giulia Agolini | Green Utility |giulia.agolini@greenutility.eu| +39 3462385512

Basalt Infrastructure Partners

press@basaltinfra.com

_____________________

ABOUT GREEN UTILITY

Founded in 2007 and headquartered in Rome, Green Utility is a vertically integrated solar PV platform. It has been an early mover in the field of distributed generation and self-consumption

for C&I clients in Italy (both rooftop and ground-mounted plants). The company aims to bring electricity production closer to consumption via solutions that allow C&I clients to optimise their electricity supply with installations dedicated to self-consumption in addition to their existing grid connections.

For more information, please visit www.greenutility.com

ABOUT BASALT

Basalt is the investment advisor to the Basalt funds. The Basalt funds are infrastructure equity investment funds focusing on mid-market investments in utilities, power, transport, and

communications infrastructure in North America and Europe. The Funds have invested c.US$7bn across 31 investments in total, including 18 European investments representing US$3.6bn.

For more information, please visit www.basaltinfra.com

LikeDiscussion

Share

Discussion

You are commenting on Green Utility acquires Mareccio Energia, a portfolio of solar PV in Italy

You must be logged in to add a comment

There are no comments

Be the first to add to the discussion

Fund manager

Infravia Capital Partners

Paris, FranceFounded in 2008, InfraVia is a leading independent private equity firm specializing in real assets - infrastructure, critical metals, real estate - and technology investments.

InfraVia is a conviction-driven investor focusing on resilient businesses partnering with management teams, entrepreneurs, or industrials to develop their businesses and drive long-term value creation through active, hands-on asset management.

InfraVia manages EUR 15 billion of capital* and invested in 50+ companies across Europe.

*Total amount of capital raised

private equityinfrastructurereal estategrowth

Related news

Green Arrow Capital grows in the spanish market. Construction underway for a 135MW solar photovoltaic portfolio

Green Arrow Capital, Stern Energy, and SMA Solar Technology complete a major inverter revamping project in Italy

Low Carbon signs two 15-year route-to-market PPAs with SSE Energy Markets

Ardian signs agreement with I Squared Capital to acquire Energia Group, a leading energy utility in Ireland

I Squared commits USD $400 million to Órigo Energia, Brazil’s largest distributed generation platform

Equitix strengthens position in Italy’s solar market by increasing its stake in joint venture with ACEA

Capital Dynamics Secures EUR 185m in Project Financing For Two of Italy’s Largest Agrivoltaic Assets in Sicily

Repsol partners with Schroders Greencoat in a 400 MW Spanish renewable portfolio valued at €580 million