True Green Capital Management LLC Elevates Adam Rasken to Partner

Quinbrook’s First Synchronous Condenser in Scotland Now Built and Operating

LS Power Completes Acquisition of Algonquin Power & Utilities Corp.’s Large Scale Renewable Energy Business

Formation of Clearlight Energy and Subsidiary REV Renewables Expands Development Platform

EnCap Flatrock Midstream Completes Two Transactions with Plains All American

Digital Edge DC raises over US$1.6 billion in new equity and debt capital to fund continued platform expansion

Consortium of STRABAG and Equitix identified as preferred bidder by UU to deliver HARP

Marguerite announces final close of Marguerite III

Excelsior Energy Capital Finalizes Multiyear 7.5 GWh Agreement with LG Energy Solution Vertech to Supply BESS for US Business

Antin Infrastructure Partners closes Flagship Fund V above €10 billion target

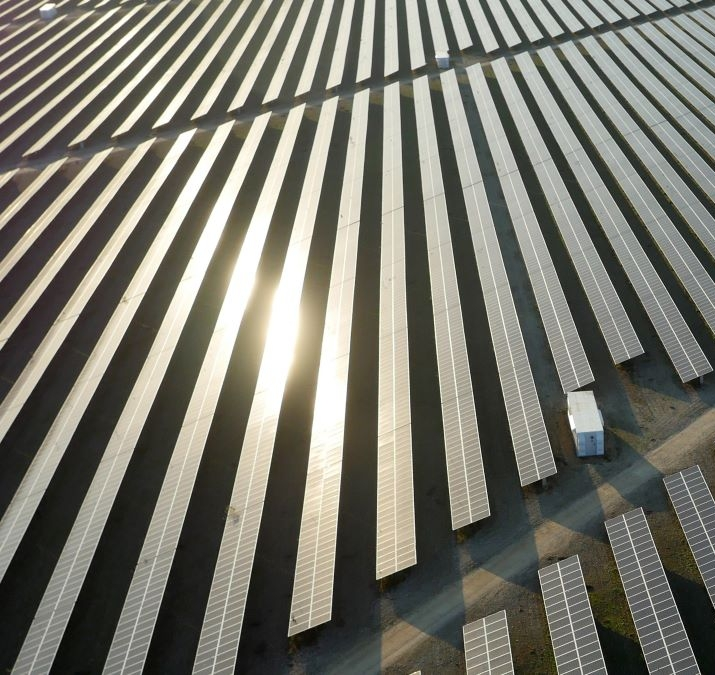

Low Carbon

London, United KingdomLow Carbon creates renewable energy to fight climate change. We’re building a global net-zero energy company that will power tomorrow and protect the planet for future generations.

Low Carbon was established in 2011 with one goal in mind: to make the biggest contribution possible in the fight against climate change. The aim is to make a defining contribution to the historic effort to move the world to 100% renewable energy.

Low Carbon are a long-standing certified B-Corporation, and recognized as Gold Standard for their environmental impact. Low Carbon’s climate ambitions are to become one of the world’s first major net-zero energy companies and to have created 20GW of new renewable energy capacity by 2030.

Low Carbon is on a mission. Together, we will power tomorrow.

infrastructure

True Green Capital Management LLC

Westport, CT, United StatesTrue Green Capital Management LLC (“TGC”) is a specialized renewable energy infrastructure fund manager with a focus in distributed power generation in the US and Europe. The Firm is international with offices in Westport, Connecticut in the US and London in the United Kingdom.

Founded in July 2011, TGC is led by a team of professionals with a proven track record and a demonstrated capacity to originate, finance, construct, and operate distributed renewable power generation projects.

TGC believes the demand for power, the continued increase of power prices, decreasing entry costs of distributed power generation technology and the efficiency of creating and delivering price-competitive electric power at the source will continue to lead to compelling investment opportunities which provide a stable cash flow stream with low correlation to the broader markets.

TGC is currently focused on investing in the US, the United Kingdom, and the EU, which account for a notable portion of the approximately $1.5 trillion global distributed power generation market, with an emphasis on the sub-utility scale solar power segment.1 Thanks to power industry deregulation combined with rapid advancements in technology, the economics of distributed power generation, including solar and batteries, are now competitive with traditional electricity generation sources. In many US states and key European jurisdictions, it represents one of the few sources of new power generation infrastructure that can be added to the power network quickly, reliably, and cost efficiently.

To date, TGC has invested into a distributed solar power generation portfolio across 18 US states, the United Kingdom and France, delivering clean, renewable energy. US states include California, Colorado, Connecticut, Delaware, Idaho, Illinois, Maryland, Massachusetts, Minnesota, New Jersey, New York, North Carolina, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, and Virginia.

infrastructure

Quinbrook Infrastructure Partners

London, United KingdomQuinbrook Infrastructure Partners (‘Quinbrook’) is a specialist investment manager focused exclusively on the infrastructure needed to drive the energy transition in the UK, US, and Australia.

Quinbrook is led and managed by a senior team of power industry professionals who have collectively invested c. USD 6.9 billion of equity capital in 40 GW of energy infrastructure assets representing a total transaction value of USD 29.8 billion.

Quinbrook's investment and asset management team has offices in New York, Houston, London and Brisbane.

Quinbrook has completed a diverse range of direct investments in both utility and distributed scale onshore wind and solar power, battery storage, reserve peaking capacity, biomass, fugitive methane recovery, hydro and flexible energy management solutions in the UK, US, and Australia. Quinbrook is currently developing and constructing some of the largest renewables and storage infrastructure projects in the UK, US, and Australia.

infrastructure

LS Power

New York, United StatesFounded in 1990, LS Power is a premier development, investment, and operating company focused on the North American power and energy infrastructure sector, with leading platforms across generation, transmission and energy transition solutions. Since inception, LS Power has developed or acquired over 47,000 MW of power generation, including utility-scale solar, wind, hydro, battery energy storage, and natural gas-fired facilities. Through LS Power Grid, we have built 780+ miles of high-voltage transmission with 350+ miles and multiple grid infrastructure projects currently under construction or in development. Across its efforts, LS Power actively invests in and scales businesses that are accelerating the energy transition, including electric vehicle charging, demand response, microgrids, renewable fuels and waste-to-energy platforms. Over the years, LS Power has raised $60 billion in debt and equity capital to support North American infrastructure.

infrastructure

EnCap Investments

Houston, Texas, United StatesEnCap Investments is the leading provider of equity capital to the independent sector of the U.S. oil and gas industry. EnCap Investments’ ongoing story begins in 1988 when the firm was established by founders David B. Miller, Gary R. Petersen, D. Martin Phillips and Robert L. Zorich. Since then, EnCap has built 30-plus-year track record of successfully identifying economic investment opportunities in evolving markets. To date, EnCap has raised 25 institutional funds and more than $47 billion in capital commitments.

private equityinfrastructuregrowth

Stonepeak

New York, United StatesStonepeak is a leading alternative investment firm specializing in infrastructure and real assets with approximately $73 billion of assets under management. Through its investment in defensive, hard-asset businesses globally, Stonepeak aims to create value for its investors and portfolio companies, with a focus on downside protection and strong risk-adjusted returns. Stonepeak, as sponsor of private equity and credit investment vehicles, provides capital, operational support, and committed partnership to grow investments in its target sectors, which include digital infrastructure, energy and energy transition, transport and logistics, and real estate. Stonepeak is headquartered in New York with offices in Houston, London, Hong Kong, Seoul, Singapore, Sydney, Tokyo, and Abu Dhabi. For more information, please visit www.stonepeak.com.

infrastructurereal estateprivate debt

Equitix

London, United KingdomWe are a responsible investor, investing in, developing and managing global infrastructure assets, which materially contribute to the lives of the communities they serve.

We employ over 200 professionals across 15 locations, managing over 360 assets in over 20 countries globally, with a current AUM of $12bn.

infrastructure

Marguerite

Luxembourg, LuxembourgMarguerite is a pan-European investor in long-life greenfield and brownfield expansion infrastructure.

Our funds seek out capital-intensive, sustainable investment opportunities with a particular focus on four sectors: (1) Energy & Renewables, (2) Digital Transformation, (3) Waste & Water and (4) Transport.

Marguerite manages four European infrastructure funds, the most recent being Marguerite III. Over the years, we’ve deployed in excess of €1.5 billion into projects designed to address the changing infrastructure landscape in Europe by integrating ESG principles and creating positive change for society.

Marguerite III benefits from support from the European Union under the InvestEU Fund.

From our origins in 2010 as an independent infrastructure investment manager backed by the European Investment Bank and the main European National Promotional Banks, we have evolved into a fund manager dedicated to generating value for investors while integrating robust ESG screening as part of our eligibility criteria and continuously measuring the positive impact of our investments.

Our team is based in Luxembourg and Paris.

infrastructure

Excelsior Energy Capital

Excelsior, United StatesExcelsior Energy Capital is a pure-play renewable energy infrastructure fund focused on long-term investments in operating wind, solar power plants, and battery storage in North America. The Excelsior Energy Capital team has a proven track record, as a group executing over $2.5 billion of equity investments across 2 GW of operating wind and solar projects. The team brings a comprehensive set of financial, legal, strategic and operational expertise – making Excelsior Energy Capital a valuable partner for developers and operators, and a trusted manager for investors.

Wind, solar, and battery storage is at last an established asset class. Technology efficiencies and installed costs have evolved to a point where wind and solar plants can compete with conventional generation such as natural gas and coal. Long-term federal tax policy and increasing state-level renewable portfolio standards are further supporting industry growth. As a result, installed capacity is expected to double as U.S. solar and wind project installations are forecasted to grow by over 120 GW by 2021 according to Bloomberg New Energy Finance. There is now extensive inventory of attractive assets presenting stable investments for institutional investors.

infrastructure

Antin Infrastructure Partners

Paris, FranceAntin Infrastructure Partners is a leading private equity firm focused on infrastructure. With over €32bn in Assets under Management, Antin targets majority stakes in the energy and environment, digital, transport and social infrastructure sectors. Based in Paris, London, New York, Singapore and Luxembourg, Antin employs over 240 professionals dedicated to growing, improving and transforming infrastructure businesses while delivering long-term value to investors and portfolio companies. Majority owned by its partners, Antin is listed on compartment A of the regulated market of Euronext Paris (Ticker: ANTIN – ISIN: FR0014005AL0)

We look for companies with potential for operational improvements and active capital management. We undertake rigorous due diligence, focusing on business fundamentals, industry and market dynamics, and then prioritise business planning and transaction management.

Antin invests in infrastructure businesses in Europe and North America across the energy and environment, digital, transport and social sectors. We employ a hands-on investment strategy focused on value creation and downside protection.

We manage funds across three strategies: Flagship, Mid Cap, NextGen

infrastructuregrowth