EQT to acquire a majority stake in Acronis, a leading cybersecurity and data protection platform for Managed Service Providers and corporate IT departments

General Atlantic Appoints Neal Kok as Managing Director and Head of Southeast Asia and Australia

Antin Infrastructure Partners, ICAMAP and Borletti Group to sell Grandi Stazioni Retail to a consortium of infrastructure investors comprising DWS and OMERS

Excelsior Energy Capital Enters Multiyear, 2.2 GWh Agreement with Fluence to Utilize Domestically Manufactured Battery Cells in US Energy Storage Projects

Publication of Grant-Funded Research Report: “Nature Positive Investment Opportunities through Solar Parks”

50MW Solar Project Portfolio Acquired in Europe

Flo Health Secures More than $200M Investment from General Atlantic to Revolutionize Women’s Health; First Purely Digital Consumer Women’s Health App to Achieve Unicorn Status

I Squared Announces Acquisition of Texas-Based Energy Services Firm, Priority Power

I Squared to Invest $200 Million for “Last-Mile” Electric Grid Infrastructure in the UK

CVC DIF

Schiphol, NetherlandsCVC DIF (formerly DIF Capital Partners) is a leading global mid-market infrastructure equity fund manager.

Founded in 2005 and headquartered in Amsterdam, the Netherlands, CVC DIF has c. €18 billion of infrastructure assets under management in energy transition, transport, utilities and digitalisation.

With over 240 people in 12 offices, CVC DIF offers a unique market approach, combining a global presence with the benefits of strong local networks and sector-focused investment capabilities.

CVC DIF forms the infrastructure strategy of leading global private markets manager CVC. This partnership allows CVC DIF to benefit from CVC’s global platform, with 30 offices across five continents.

infrastructure

EQT Group

Stockholm, SwedenEQT is a purpose-driven global investment organisation with nearly three decades of consistent investment performance across multiple geographies, sectors, and strategies

buyoutprivate equityinfrastructurereal estategrowthvc

General Atlantic

New York, United StatesGeneral Atlantic is a leading global investor with more than four decades of experience providing capital and strategic support for over 500 growth companies throughout its history. Established in 1980 to partner with visionary entrepreneurs and deliver lasting impact, the firm combines a collaborative global approach, sector specific expertise, a long-term investment horizon and a deep understanding of growth drivers to partner with great entrepreneurs and management teams to scale innovative businesses around the world. General Atlantic has more than $77 billion in assets under management inclusive of all products as of June 30, 2023, and more than 220 investment professionals based in New York, Amsterdam, Beijing, Hong Kong, Jakarta, London, Mexico City, Miami, Mumbai, Munich, San Francisco, São Paulo, Shanghai, Singapore, Stamford and Tel Aviv.

private equityinfrastructuregrowthprivate debt

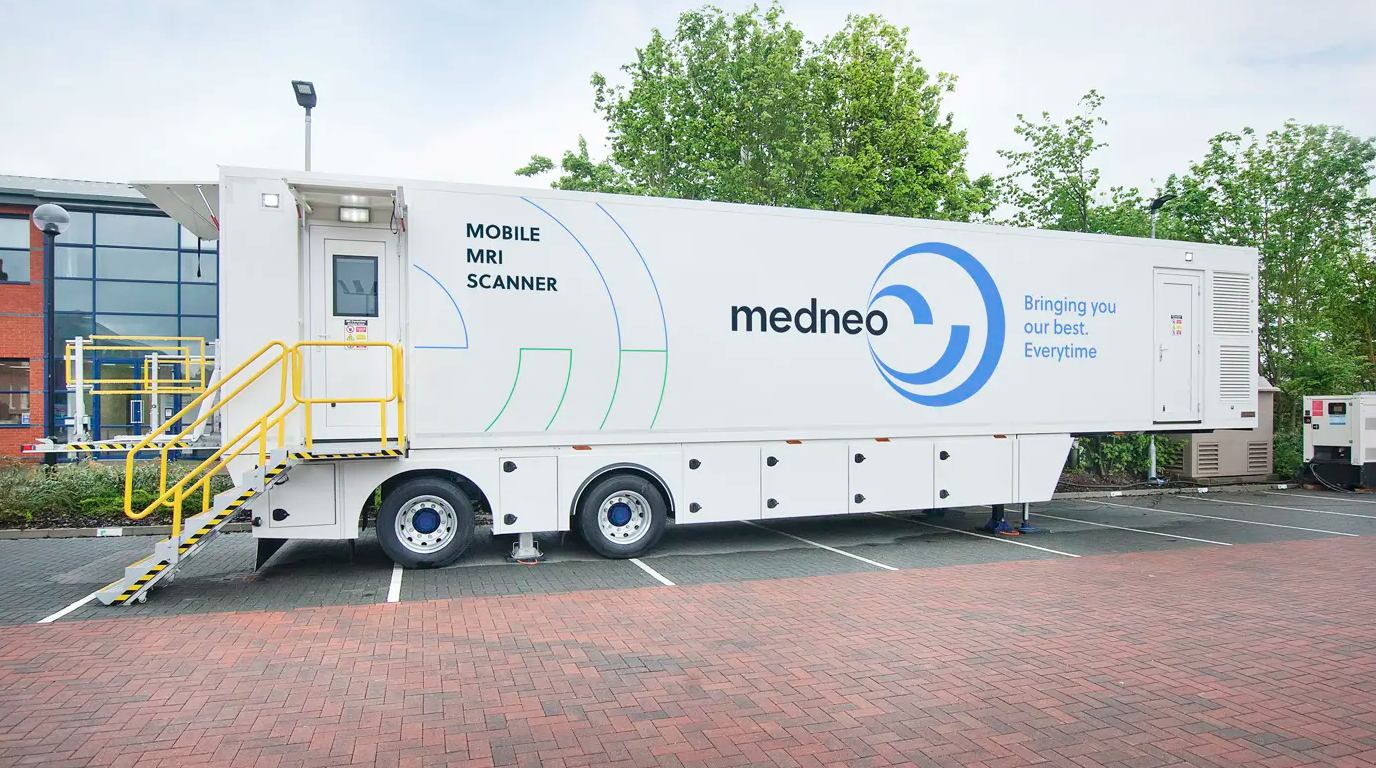

Antin Infrastructure Partners

Paris, FranceAntin Infrastructure Partners is a leading private equity firm focused on infrastructure. With over €32bn in Assets under Management, Antin targets majority stakes in the energy and environment, digital, transport and social infrastructure sectors. Based in Paris, London, New York, Singapore and Luxembourg, Antin employs over 240 professionals dedicated to growing, improving and transforming infrastructure businesses while delivering long-term value to investors and portfolio companies. Majority owned by its partners, Antin is listed on compartment A of the regulated market of Euronext Paris (Ticker: ANTIN – ISIN: FR0014005AL0)

We look for companies with potential for operational improvements and active capital management. We undertake rigorous due diligence, focusing on business fundamentals, industry and market dynamics, and then prioritise business planning and transaction management.

Antin invests in infrastructure businesses in Europe and North America across the energy and environment, digital, transport and social sectors. We employ a hands-on investment strategy focused on value creation and downside protection.

We manage funds across three strategies: Flagship, Mid Cap, NextGen

infrastructuregrowth

Excelsior Energy Capital

Excelsior, United StatesExcelsior Energy Capital is a pure-play renewable energy infrastructure fund focused on long-term investments in operating wind, solar power plants, and battery storage in North America. The Excelsior Energy Capital team has a proven track record, as a group executing over $2.5 billion of equity investments across 2 GW of operating wind and solar projects. The team brings a comprehensive set of financial, legal, strategic and operational expertise – making Excelsior Energy Capital a valuable partner for developers and operators, and a trusted manager for investors.

Wind, solar, and battery storage is at last an established asset class. Technology efficiencies and installed costs have evolved to a point where wind and solar plants can compete with conventional generation such as natural gas and coal. Long-term federal tax policy and increasing state-level renewable portfolio standards are further supporting industry growth. As a result, installed capacity is expected to double as U.S. solar and wind project installations are forecasted to grow by over 120 GW by 2021 according to Bloomberg New Energy Finance. There is now extensive inventory of attractive assets presenting stable investments for institutional investors.

infrastructure

NextEnergy Capital

London, United KingdomNextEnergy Capital was founded in 2007 to become the leading specialist investment and asset manager in the solar sector.

Our mission is to generate a more sustainable future by leading the transition to clean energy.

We manage multiple private and public investment platforms and are the leading global operating asset manager of solar power projects.

infrastructure

I Squared Capital

Miami, United StatesI Squared Capital is a leading independent global infrastructure manager with over $40 billion in assets under management focused on investing in North America, Europe, Asia, and Latin America. The firm is headquartered in Miami and has more than 280 professionals across its offices in Abu Dhabi, London, Munich, New Delhi, São Paulo, Singapore, Sydney, and Taipei.

infrastructureprivate debt