Investec Direct Lending and Carlyle AlpInvest partner on launch of Investec’s inaugural European senior debt fund

X-energy Closes Oversubscribed $700 Million Series D Financing Round to Continue Expansion to Meet Global Energy Demand

GTCR Announces Acquisition of Fiduciary Trust Company

Infrastructure Beyond Earth: The Next Frontier of Real Assets

Blackstone Energy Transition Partners Announces $1.2 Billion Investment to Build First-ever Natural Gas Power Generation Facility in West Virginia

Copenhagen Infrastructure Partners and Norfund enter partnership on Mulilo

Youngtimers Announces Potential US$90 Million Equity Raise, Forming Strategic Partnership with DL Holdings

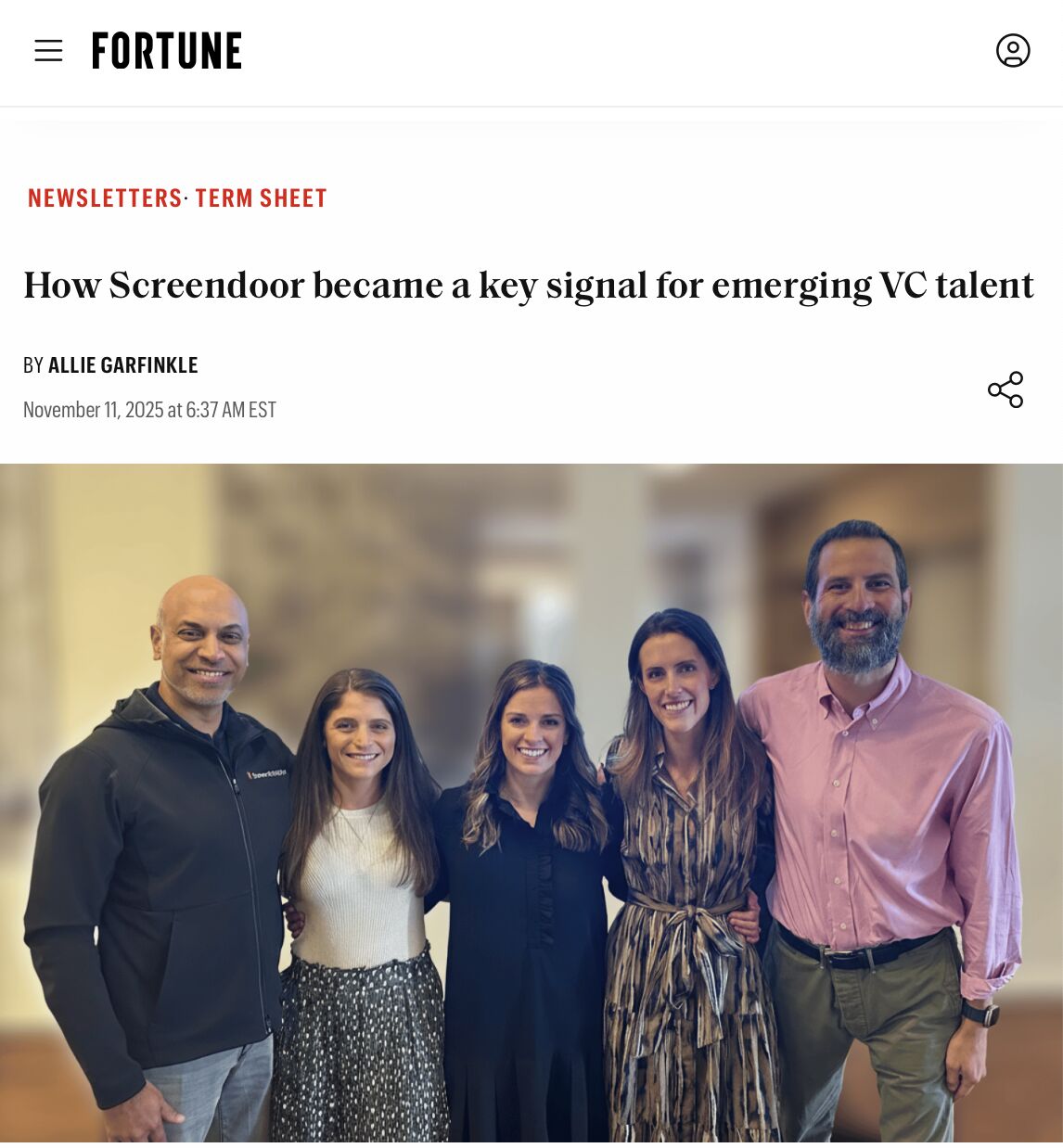

Fortune: how Screendoor became a key signal for emerging VC talent

Atlético de Madrid to Welcome Apollo Sports Capital as Majority Shareholder

Energy Capital Partners

Summit, New Jersey, United StatesECP (Energy Capital Partners) is an investor in critical infrastructure focused on electrification, decarbonization, reliability and sustainability. Founded in 2005, ECP’s investment team has an early mover advantage in the sector as we have been successfully investing through multiple energy transitions over the last 30 years, including ECP’s senior partners whom have been investing in critical electrification and decarbonization real asset infrastructure since the mid 1990s and are experienced owners of ESG-related businesses. With 100 employees and over 825+ years of cumulative energy experience, ECP is built on cutting edge strategies and opportunities linked to decarbonization and clean energy.

buyoutprivate equity

Carlyle Group

Washington, DC, United StatesCarlyle (NASDAQ: CG) is a global investment firm with deep industry expertise that deploys private capital across three business segments: Global Private Equity, Global Credit, and Global Investment Solutions. With $441 billion of assets under management as of December 31, 2024, Carlyle’s purpose is to invest wisely and create value on behalf of its investors, portfolio companies, and the communities in which we live and invest. Carlyle employs more than 2,300 people in 29 offices across four continents.

buyoutprivate equityinfrastructureprivate debt

NGP Energy Technology Partners

Dallas, Texas, United Statest is undeniable that energy is an essential part of modern life. For over 34 years, NGP has been a pioneer in the North American energy industry—always keeping an innovative eye on the future.

At our core, we are energy investors and business builders. Our investments have fostered entrepreneurship, driven innovation, created jobs, advanced U.S. energy security, and supported the critical missions of our stakeholders. Today, we are one of the most trusted private equity energy investors.

Our strategy has evolved to a changing energy environment. We have supported hundreds of businesses across upstream, midstream, renewables and energy technology. We have served as good stewards of capital while developing and sustaining an ecosystem that supports all solutions that strengthen the energy sector.

In a time of historic change, our vision is to apply our collective expertise in natural resources and energy transition to identify opportunities to accelerate advances to meet the world’s energy needs.

It’s a vision that is Moving Energy Forward.

infrastructure

GTCR

Chicago. Illinois, United StatesFounded in 1980, GTCR is a leading private equity firm that pioneered The Leaders Strategy™ – finding and partnering with management leaders in core domains to identify, acquire and build market-leading companies through organic growth and strategic acquisitions. GTCR is focused on investing in transformative growth in companies in the Business & Consumer Services, Financial Services & Technology, Healthcare and Technology, Media & Telecommunications sectors. Since its inception, GTCR has invested more than $24 billion in over 270 companies, and the firm currently manages over $27 billion in equity capital. GTCR is based in Chicago with offices in New York and West Palm Beach.

buyoutprivate equity

Space4Earth

Luxembourg City, LuxembourgSpace4Earth (S4E Capital) is a visionary investment fund dedicated to accelerating the transformation of space technologies into real-world solutions. We believe the future of earth is being shaped in orbit — and we exist to ensure that the most promising innovations in space reach the ground with purpose, precision, and impact. S4E Capital is a specialist venture capital firm investing in satellite-enabled, dual-use (defence and commercial) technologies that address global sustainability challenges. The fund is led by a team with deep expertise across space technology, sustainability, and institutional capital markets — combining technical and industry insight with disciplined investment experience. Citicourt & Co is a London based regulated corporate finance firm specialising in, amongst other sectors, space and aerospace, and is the regulated advisor to the Fund.

private equityvc

Blackstone Group

New York, United StatesBlackstone is the world’s largest alternative asset manager. We seek to deliver compelling returns for institutional and individual investors by strengthening the companies in which we invest. Our more than $1 trillion in assets under management include global investment strategies focused on real estate, private equity, infrastructure, life sciences, growth equity, credit, real assets, secondaries and hedge funds.

buyoutprivate equityinfrastructurereal estategrowthprivate debt

Copenhagen Infrastructure Partners

Copenhagen O, DenmarkCIP is a global, multi-strategy fund manager specialising in renewable energy infrastructure investments and is among the largest fund managers globally within renewables with 12 funds raised to date and approximately EUR 28 billion in aggregate commitments to date.

infrastructure

C Capital

Hong Kong, Hong Kong SAR ChinaFound in 2017 C Capital is a Swiss listed APAC Private Markets platform active across private and private credit.

Since our inception, we have demonstrated an impressive track record by strategically managing a private equity fund and a private credit fund.

In September 2022, we underwent a significant rebranding and emerged as C Capital, reflecting our evolution and commitment to diversifying investment strategies. We have expanded our portfolio to include private credit and hedge funds, while maintaining a focus on disrupting industries in the consumer, technology, and blockchain sectors worldwide.

At C Capital, we go beyond traditional asset management – we empower and accompany successful entrepreneurs on their journey. With a hands-on approach, we have invested in more than 60 portfolio companies, boasting an impressive achievement of nurturing 20 unicorns among them. Our involvement spans the entire growth trajectory, leading deals from Series A to Series C stages, ensuring sustained success for our partners.

One of the distinctive features of our ecosystem is its wide-reaching impact, with a daily touch point on 15 million consumers. This expansive network enhances our ability to identify and capitalise on emerging opportunities, further solidifying C Capital's position as a forward-thinking and influential force in the global investment landscape.

private equitygrowth

Screendoor

USA, United StatesScreendoor is a venture capital fund of funds platform for the next generation of venture capital firms. Uniquely founded

by accomplished GPs alongside institutional LPs with over a decade of experience, we invest anchor LP capital in new fund

managers and provide them with curated mentorship from our iconic GP Advisors. Since inception, Screendoor has

evaluated over 90% of new funds launched, giving the firm unmatched visibility into the early-stage VC landscape.

Screendoor is both a signal and a partner, helping new GPs get in business and scale smarter to become an enduring firm.

For LPs, Screendoor offers investors differentiated exposure, early visibility into rising firms and the notoriously opaque VC

ecosystem, and a refined pipeline of transparent, direct relationships. We serve as an extension of LP teams to identify

and access alpha before it becomes consensus so that institutions can build stronger, more effective venture portfolios

with greater precision and purpose. Backed by long-term, patient capital, Screendoor is reshaping how the next

generation of VCs get their start—and how great firms are built.

private equityfund of funds

Apollo Global Management

New York, United StatesApollo is a high-growth, global alternative asset manager. In our asset management business, we seek to provide our clients excess return at every point along the risk-reward spectrum from investment grade credit to private equity. For more than three decades, our investing expertise across our fully integrated platform has served the financial return needs of our clients and provided businesses with innovative capital solutions for growth. Through Athene, our retirement services business, we specialize in helping clients achieve financial security by providing a suite of retirement savings products and acting as a solutions provider to institutions. Our patient, creative, and knowledgeable approach to investing aligns our clients, businesses we invest in, our employees, and the communities we impact, to expand opportunity and achieve positive outcomes.

buyoutprivate equityinfrastructure