Green Arrow Capital and Lazzari&Lucchini enter into an agreement for the sale of Biomethane plants to Verdalia Bioenergy

Green Arrow Capital and Lazzari&Lucchini enter into an agreement for the

sale of Biomethane plants to Verdalia Bioenergy

(Goldman Sachs Asset Management)

The deal involves the sellers’ first portfolio of assets, amongst the most important in

Italy, with a production capacity of 190 GWh

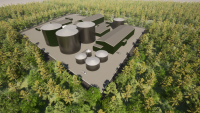

Rome/Brescia, 21 May 2024 – Four years after the launch of their innovative project, Green Arrow Capital (“GAC”), one of the leading Italian independent operators in alternative investments, and Lazzari&Lucchini (“L&L”), leading company in energy production from natural resources, announce the signing of an agreement for the sale of their first portfolio of biomethane production plants. The operation involves a portfolio of 7 plants, each with a capacity of approx. 300 Sm3/h of biomethane, located in the province of Brescia, which were the first projects incentivized pursuant to the “Biometano 2018” Ministerial Decree.

The contract was signed by Green Arrow Capital and Lazzari&Lucchini, acting as sellers, and Verdalia Bioenergy, a Goldman Sachs Asset Management portfolio company of infrastructural funds focusing on the biomethane, as the buyer. The completion of the agreement is subject to the fulfillment of certain standard conditions for this sort of transaction.

GAC and L&L thus cement their leadership by planning on furthering their existing partnership, which finds them at the forefront in the management and development of Italy’s strategic assets in main renewable technologies (hydro and wind), as well as in Biomethane. The two players are already involved in the construction of a second portfolio made out of 6 plants, incentivized pursuant to the Ministerial Decree currently in force “Nuovo Biometano 2022”.

The plants covered by the agreement, built by GAC and L&L, contribute to generating significant energy and environmental benefits through the yearly production of 190 GWh of biomethane. This is achieved through the anaerobic digestion of 350,000 annual tonnes of livestock and agricultural production waste.

Daniele Camponeschi (GAC Founder and CIO), stated: “We’re extremely satisfied with the results achieved alongside Lazzari&Lucchini, as well as with the agreement signed with Verdalia Bioenergy and an international player of such magnitude as Goldman Sachs Asset Management. The deal confirms Green Arrow Capital’s commitment to being a virtuous investor, one that is able to implement strategic projects for its Country and to generate value for its investors and stakeholders. A commitment further confirmed by an additional exclusive pipeline comprised of 25 Biomethane projects”.

Anna Lazzari (L&L President) commented: “This is a very important and positive agreement. When such an important international player such as Goldman Sachs Asset Management investsin the biomethane sector, and so significantly in our territory, it grants substance to the expectations linked to the energy transition. We hope it can be a source of satisfaction and pride for the entire territory as well. Service Companies also fall within the scope of the operation, so as to guarantee business continuity for workers and suppliers”.

For Green Arrow Capital, the deal was led by Founder and CIO Daniele Camponeschi and Investment Director Giulio Barendson, with associates Francesca Marongiu and Alvise Panizzi. For Lazzari&Lucchini, the transaction was conducted by President Anna Lazzari, along with General Counsel Alessandro Grassi and CFO Giuseppe Tinti.

Advisors: GAC and L&L were assisted by MFZ (Luciano Garofano, Matteo Ascione and Antonio Esposito), as financial advisors, by Parola & Associati (Lorenzo Parola, Andrea Coluzzi and Federica Re) for legal and regulatory aspects, and by AFRY (Antonio Michelon and Giuseppe Latorre) for technical aspects.

GREEN ARROW CAPITAL

Green Arrow Capital is one of the leading Italian independent operators in alternative investments, with €2 billion assets historically raised. To date, around 200 entities have invested into GAC’s funds, almost 90% of which are represented by institutions (Banks, Sovereign Funds, Funds of Funds, Banking Foundations, Insurance Funds, Pension Funds, and Insurance Companies) and around 20% are of international origin. Green Arrow Capital was founded in 2012 by Eugenio de Blasio, Group’s major shareholder as well as Chairman and CEO, together with co-founder Daniele Camponeschi (Group CIO) and partner Alessandro Di Michele (Group GM and CFO). The Partner and Deputy Chairman of SGR Francesco Maria Giovannini is actively involved in institutional relations. The Group operates in three different investment strategies - Clean Energy & Infrastructure, Private Equity, and Private Credit - with dedicated and independent teams, and has currently in fundraising the second Private Debt fund (GAPDF II) and the fourth Private Equity fund (GAPEF IV Italian Champions) supporting excellent Italian SMEs, as well as the Infrastructure of the Future Fund (GAIF), which invests in renewable energy and digital infrastructure in high-potential markets in Europe.

LAZZARI&LUCCHINI

The L&L group is dynamic and innovative, with a defined strategy and long-term industrial vision. The business integrates principles of circular economy and sustainable development and is based on products and services characterised by a predominant environmental and social value. The group is among the leading players in the clean and renewable energy sector: it designs and manages high-tech facilities for energy production from wind, water, and agro-zootechnical by-products. Competence, reliability, and flexibility make the Brescia-based company an ideal partner for achieving the energy transition goals outlined by the European Green Deal and established by the Italian government in the National Recovery and Resilience Plan (NRRP). Lazzari&Lucchini, founded in 2014, was born from the union of two specific expertise, those of Imerio Lucchini, hydro-electric plant constructor, and Anna Lazzari, energy trading expert.

FOR FURHTER INFORMATION:

L&L SpA Press Office Stefania Itolli- Mob. +39 336 387531 ufficiostampa@lazzarilucchini.com

Green Arrow Capital Press Office: Close to Media – Communication Advisors Adriana Liguori: Mob. +39 345.1778974 - adriana.liguori@closetomedia.it Paolo Ferrario: Mob. +39 337.1064754 – paolo.ferrario@closetomedia.it Federico Maggioni: Mob. +39 393.8150958 – federico.maggioni@closetomedia.it

The contract was signed by Green Arrow Capital and Lazzari&Lucchini, acting as sellers, and Verdalia Bioenergy, a Goldman Sachs Asset Management portfolio company of infrastructural funds focusing on the biomethane, as the buyer. The completion of the agreement is subject to the fulfillment of certain standard conditions for this sort of transaction.

GAC and L&L thus cement their leadership by planning on furthering their existing partnership, which finds them at the forefront in the management and development of Italy’s strategic assets in main renewable technologies (hydro and wind), as well as in Biomethane. The two players are already involved in the construction of a second portfolio made out of 6 plants, incentivized pursuant to the Ministerial Decree currently in force “Nuovo Biometano 2022”.

The plants covered by the agreement, built by GAC and L&L, contribute to generating significant energy and environmental benefits through the yearly production of 190 GWh of biomethane. This is achieved through the anaerobic digestion of 350,000 annual tonnes of livestock and agricultural production waste.

Daniele Camponeschi (GAC Founder and CIO), stated: “We’re extremely satisfied with the results achieved alongside Lazzari&Lucchini, as well as with the agreement signed with Verdalia Bioenergy and an international player of such magnitude as Goldman Sachs Asset Management. The deal confirms Green Arrow Capital’s commitment to being a virtuous investor, one that is able to implement strategic projects for its Country and to generate value for its investors and stakeholders. A commitment further confirmed by an additional exclusive pipeline comprised of 25 Biomethane projects”.

Anna Lazzari (L&L President) commented: “This is a very important and positive agreement. When such an important international player such as Goldman Sachs Asset Management investsin the biomethane sector, and so significantly in our territory, it grants substance to the expectations linked to the energy transition. We hope it can be a source of satisfaction and pride for the entire territory as well. Service Companies also fall within the scope of the operation, so as to guarantee business continuity for workers and suppliers”.

For Green Arrow Capital, the deal was led by Founder and CIO Daniele Camponeschi and Investment Director Giulio Barendson, with associates Francesca Marongiu and Alvise Panizzi. For Lazzari&Lucchini, the transaction was conducted by President Anna Lazzari, along with General Counsel Alessandro Grassi and CFO Giuseppe Tinti.

Advisors: GAC and L&L were assisted by MFZ (Luciano Garofano, Matteo Ascione and Antonio Esposito), as financial advisors, by Parola & Associati (Lorenzo Parola, Andrea Coluzzi and Federica Re) for legal and regulatory aspects, and by AFRY (Antonio Michelon and Giuseppe Latorre) for technical aspects.

GREEN ARROW CAPITAL

Green Arrow Capital is one of the leading Italian independent operators in alternative investments, with €2 billion assets historically raised. To date, around 200 entities have invested into GAC’s funds, almost 90% of which are represented by institutions (Banks, Sovereign Funds, Funds of Funds, Banking Foundations, Insurance Funds, Pension Funds, and Insurance Companies) and around 20% are of international origin. Green Arrow Capital was founded in 2012 by Eugenio de Blasio, Group’s major shareholder as well as Chairman and CEO, together with co-founder Daniele Camponeschi (Group CIO) and partner Alessandro Di Michele (Group GM and CFO). The Partner and Deputy Chairman of SGR Francesco Maria Giovannini is actively involved in institutional relations. The Group operates in three different investment strategies - Clean Energy & Infrastructure, Private Equity, and Private Credit - with dedicated and independent teams, and has currently in fundraising the second Private Debt fund (GAPDF II) and the fourth Private Equity fund (GAPEF IV Italian Champions) supporting excellent Italian SMEs, as well as the Infrastructure of the Future Fund (GAIF), which invests in renewable energy and digital infrastructure in high-potential markets in Europe.

LAZZARI&LUCCHINI

The L&L group is dynamic and innovative, with a defined strategy and long-term industrial vision. The business integrates principles of circular economy and sustainable development and is based on products and services characterised by a predominant environmental and social value. The group is among the leading players in the clean and renewable energy sector: it designs and manages high-tech facilities for energy production from wind, water, and agro-zootechnical by-products. Competence, reliability, and flexibility make the Brescia-based company an ideal partner for achieving the energy transition goals outlined by the European Green Deal and established by the Italian government in the National Recovery and Resilience Plan (NRRP). Lazzari&Lucchini, founded in 2014, was born from the union of two specific expertise, those of Imerio Lucchini, hydro-electric plant constructor, and Anna Lazzari, energy trading expert.

FOR FURHTER INFORMATION:

L&L SpA Press Office Stefania Itolli- Mob. +39 336 387531 ufficiostampa@lazzarilucchini.com

Green Arrow Capital Press Office: Close to Media – Communication Advisors Adriana Liguori: Mob. +39 345.1778974 - adriana.liguori@closetomedia.it Paolo Ferrario: Mob. +39 337.1064754 – paolo.ferrario@closetomedia.it Federico Maggioni: Mob. +39 393.8150958 – federico.maggioni@closetomedia.it

LikeDiscussion

Share

Discussion

You are commenting on Green Arrow Capital and Lazzari&Lucchini enter into an agreement for the sale of Biomethane plants to Verdalia Bioenergy

You must be logged in to add a comment

There are no comments

Be the first to add to the discussion

Fund manager

Green Arrow Captial

Rome, ItalyGreen Arrow Capital is a Pan-European independent financial group specialized in alternative investments aimed at generating sustainable returns in infrastructure, private equity and private credit.

Founded in 2012, Green Arrow Capital is one of the leading independent alternative platforms in Italy and amongst the top 10 European Renewable Infrastructural energy asset managers. Our mission is to protect the principal while generating sustainable returns for our investors, embedding ESG in every aspect of the business and into our company’s long-term value creation process.

Top managers with strong financial and industrial backgrounds and extensive experience in major European financial institutions, have come together to create a unique platform, capable of connecting Alternative Investments and Real Economy through dedicated Private Equity, Private Credit and Energy & Digital Infrastructure Funds.

buyoutprivate equityinfrastructurereal estateprivate debt

Related news

Green Arrow Capital and Lazzari&Lucchini grow in the Biomethane sector

Equitix welcomes financing partnership to support Andion’s European biomethane growth

Capital Dynamics Secures EUR 185m in Project Financing For Two of Italy’s Largest Agrivoltaic Assets in Sicily

Equitix Partnership Confirmed For Construction Of Greenfield Renewable Energy Project, Sweden

Heygaz Biomethane has entered into an agreement to acquire Ormonde Organics, a leading Irish biomethane platform

Copenhagen Infrastructure Partners Announces Greengate Biogas Partnership in Ireland

Green Utility acquires Mareccio Energia, a portfolio of solar PV in Italy

Marguerite exits investment in Greenalia’s 50mw biomass plant following successful project refinancing