Marguerite exits investment in Greenalia’s 50mw biomass plant following successful project refinancing

Greenalia, a biomass power plant in Galicia, Spain, secured refinancing from Incus Capital on December 12, 2023, to replace its existing senior debt and mezzanine loan.

Luxembourg, 11/01/2024 – Greenalia, a biomass electric power production plant in Spain’s Galicia region, secured a senior debt package from Incus Capital to refinance the existing senior debt and mezzanine. The deal was closed on 12 December 2023.

The existing senior debt had been provided by EIB, ICO and Santander – with a portion covered by insurance from the Finnish ECA, Finnvera – and a EUR 23m mezzanine loan was provided by Marguerite II in 2018. The funds were raised to finance the construction of the plant in La Coruña’s municipalities of Curtis and Teixeiro (Galicia, Spain).

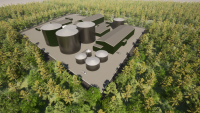

The Curtis-Teixeiro biomass plant has a capacity of approximately 50 MWe, built on a land plot of 103,000m2, and started to produce electricity in 2020. It is expected to generate 370GWh per year from forest waste collected within a radius of 100 km around the new installation. To produce this energy, the plant uses about 570,000 tonnes of forest biomass a year.

The existing senior debt had been provided by EIB, ICO and Santander – with a portion covered by insurance from the Finnish ECA, Finnvera – and a EUR 23m mezzanine loan was provided by Marguerite II in 2018. The funds were raised to finance the construction of the plant in La Coruña’s municipalities of Curtis and Teixeiro (Galicia, Spain).

The Curtis-Teixeiro biomass plant has a capacity of approximately 50 MWe, built on a land plot of 103,000m2, and started to produce electricity in 2020. It is expected to generate 370GWh per year from forest waste collected within a radius of 100 km around the new installation. To produce this energy, the plant uses about 570,000 tonnes of forest biomass a year.

The project provides substantial socio-economic benefits as it allows better use of harvest residues as a source of energy (reducing the use of fossil fuels), contributing to forest maintenance in the area and fire prevention by encouraging the collection of small-sized wood waste for industrial use that is normally discarded. The biomass used by the plant is either FSC or PEFC-certified.

This project was one of the first to be implemented under the new regulatory framework for the industry approved in Spain in 2013. Greenalia was the winning bidder in Spain’s first auction for new renewables-based power generation facilities in early 2016, which allowed the Curtis-Teixeiro plant to benefit from a 25-year regulated tariff.

William Pierson, Managing Partner at Marguerite, said: “We are pleased that Marguerite could provide Greenalia crucial support in providing needed capital for the successful construction of one of the major biomass projects in Spain and secure a successful exit”.

In this transaction, Marguerite was advised by Pérez-Llorca (legal).

LikeDiscussion

Share

Discussion

You are commenting on Marguerite exits investment in Greenalia’s 50mw biomass plant following successful project refinancing

You must be logged in to add a comment

There are no comments

Be the first to add to the discussion

Fund manager

Marguerite

Luxembourg, LuxembourgMarguerite is a pan-European investor in long-life greenfield and brownfield expansion infrastructure.

Our funds seek out capital-intensive, sustainable investment opportunities with a particular focus on four sectors: (1) Energy & Renewables, (2) Digital Transformation, (3) Waste & Water and (4) Transport.

Marguerite manages four European infrastructure funds, the most recent being Marguerite III. Over the years, we’ve deployed in excess of €1.5 billion into projects designed to address the changing infrastructure landscape in Europe by integrating ESG principles and creating positive change for society.

Marguerite III benefits from support from the European Union under the InvestEU Fund.

From our origins in 2010 as an independent infrastructure investment manager backed by the European Investment Bank and the main European National Promotional Banks, we have evolved into a fund manager dedicated to generating value for investors while integrating robust ESG screening as part of our eligibility criteria and continuously measuring the positive impact of our investments.

Our team is based in Luxembourg and Paris.

infrastructure

Related news

Qualitas Energy closes €34.5 million deal to finance the construction of a 90 MWp solar PV portfolio in Spain

Green Arrow Capital and Lazzari&Lucchini grow in the Biomethane sector

Green Arrow Capital and Lazzari&Lucchini enter into an agreement for the sale of Biomethane plants to Verdalia Bioenergy

Green Arrow Capital grows in the spanish market. Construction underway for a 135MW solar photovoltaic portfolio

Two CIP projects successful in the first European Hydrogen Bank auction

Green Utility acquires Mareccio Energia, a portfolio of solar PV in Italy

Low Carbon signs two 15-year route-to-market PPAs with SSE Energy Markets

Equitix Partnership Confirmed For Construction Of Greenfield Renewable Energy Project, Sweden