Copenhagen Infrastructure Partners to partially divest Coalburn 1

Apollo Funds Form $220 Million Community Solar Joint Venture with Bullrock Energy Ventures

Low Carbon and Danske Commodities sign balancing agreement for UK solar farm

Stonepeak Launches Montera Infrastructure

Stonepeak Partners with Dupré Logistics

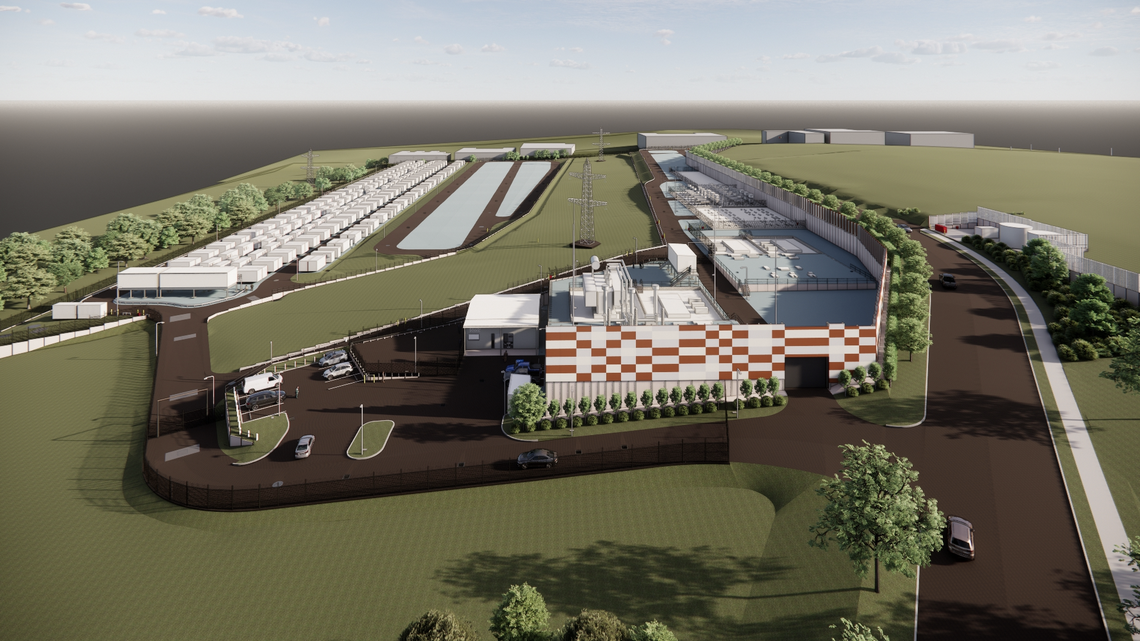

Quinbrook Fully Contracts ‘Supernode’ Battery Storage Project

Stonepeak to Acquire Majority Interest in IOR

ARCLIGHT TO ACQUIRE KLEEN POWER INTERESTS

Mora Energy Announces Formation and Partnership With NGP and Old Ironsides Energy

Stonepeak

New York, United StatesStonepeak is a leading alternative investment firm specializing in infrastructure and real assets with approximately $73 billion of assets under management. Through its investment in defensive, hard-asset businesses globally, Stonepeak aims to create value for its investors and portfolio companies, with a focus on downside protection and strong risk-adjusted returns. Stonepeak, as sponsor of private equity and credit investment vehicles, provides capital, operational support, and committed partnership to grow investments in its target sectors, which include digital infrastructure, energy and energy transition, transport and logistics, and real estate. Stonepeak is headquartered in New York with offices in Houston, London, Hong Kong, Seoul, Singapore, Sydney, Tokyo, and Abu Dhabi. For more information, please visit www.stonepeak.com.

infrastructurereal estateprivate debt

Copenhagen Infrastructure Partners

Copenhagen O, DenmarkCIP is a global, multi-strategy fund manager specialising in renewable energy infrastructure investments and is among the largest fund managers globally within renewables with 12 funds raised to date and approximately EUR 28 billion in aggregate commitments to date.

infrastructure

Apollo Global Management

New York, United StatesApollo is a high-growth, global alternative asset manager. In our asset management business, we seek to provide our clients excess return at every point along the risk-reward spectrum from investment grade credit to private equity. For more than three decades, our investing expertise across our fully integrated platform has served the financial return needs of our clients and provided businesses with innovative capital solutions for growth. Through Athene, our retirement services business, we specialize in helping clients achieve financial security by providing a suite of retirement savings products and acting as a solutions provider to institutions. Our patient, creative, and knowledgeable approach to investing aligns our clients, businesses we invest in, our employees, and the communities we impact, to expand opportunity and achieve positive outcomes.

buyoutprivate equityinfrastructure

Low Carbon

London, United KingdomLow Carbon creates renewable energy to fight climate change. We’re building a global net-zero energy company that will power tomorrow and protect the planet for future generations.

Low Carbon was established in 2011 with one goal in mind: to make the biggest contribution possible in the fight against climate change. The aim is to make a defining contribution to the historic effort to move the world to 100% renewable energy.

Low Carbon are a long-standing certified B-Corporation, and recognized as Gold Standard for their environmental impact. Low Carbon’s climate ambitions are to become one of the world’s first major net-zero energy companies and to have created 20GW of new renewable energy capacity by 2030.

Low Carbon is on a mission. Together, we will power tomorrow.

infrastructure

Quinbrook Infrastructure Partners

London, United KingdomQuinbrook Infrastructure Partners (‘Quinbrook’) is a specialist investment manager focused exclusively on the infrastructure needed to drive the energy transition in the UK, US, and Australia.

Quinbrook is led and managed by a senior team of power industry professionals who have collectively invested c. USD 6.9 billion of equity capital in 40 GW of energy infrastructure assets representing a total transaction value of USD 29.8 billion.

Quinbrook's investment and asset management team has offices in New York, Houston, London and Brisbane.

Quinbrook has completed a diverse range of direct investments in both utility and distributed scale onshore wind and solar power, battery storage, reserve peaking capacity, biomass, fugitive methane recovery, hydro and flexible energy management solutions in the UK, US, and Australia. Quinbrook is currently developing and constructing some of the largest renewables and storage infrastructure projects in the UK, US, and Australia.

infrastructure

ArcLight Capital Partners

Boston. MA, United StatesArcLight is a leading infrastructure investor which has been investing in critical electrification infrastructure since its founding in 2001. ArcLight has owned, controlled or operated over ~65 GW of assets and 47,000 miles of electric and gas transmission and storage infrastructure representing $80 billion of enterprise value. ArcLight has a long and proven track record of value-added investing across its core investment sectors including power, hydro, solar, wind, battery storage, electric transmission and natural gas transmission and storage infrastructure to support the growing need for power, reliability, security, and sustainability. ArcLight's team employs an operationally intensive investment approach that benefits from its dedicated in-house strategic, technical, operational, and commercial specialists, as well as the firm's ~1,900-person asset management partner.

infrastructure

NGP Energy Technology Partners

Dallas, Texas, United Statest is undeniable that energy is an essential part of modern life. For over 34 years, NGP has been a pioneer in the North American energy industry—always keeping an innovative eye on the future.

At our core, we are energy investors and business builders. Our investments have fostered entrepreneurship, driven innovation, created jobs, advanced U.S. energy security, and supported the critical missions of our stakeholders. Today, we are one of the most trusted private equity energy investors.

Our strategy has evolved to a changing energy environment. We have supported hundreds of businesses across upstream, midstream, renewables and energy technology. We have served as good stewards of capital while developing and sustaining an ecosystem that supports all solutions that strengthen the energy sector.

In a time of historic change, our vision is to apply our collective expertise in natural resources and energy transition to identify opportunities to accelerate advances to meet the world’s energy needs.

It’s a vision that is Moving Energy Forward.

infrastructure