Bain Capital and Stoneweg to expand Italian logistics development JV with €200 million investment

The JV’s AUM and pipeline in Italy now totals 330,000 sqm across five schemes, with a GDV of c.€500 million

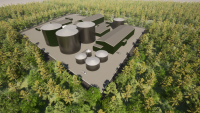

LONDON – June 3, 2025 – Bain Capital, a global private investment firm, and Stoneweg, the alternative investment group specializing in Real Assets, on behalf of their Italian value add logistics Joint Venture (the “JV”), have agreed to forward purchase, from the leading Italian logistics developer VLD, a €200 million portfolio of six, grade A logistics warehouses, in three locations, totaling 225,000 sqm of GLA.

Located in established logistics hubs, the investments underscore the JV’s high conviction in a sector where muted development activity is keeping vacancy rates contained and driving attractive rental growth prospects, and a market where tenant demand is being underpinned by compelling demographic and favorable evolving consumers behaviors.

The portfolio comprises:

- In Greater Florence, a 45,000 sqm development across two buildings, currently undergoing construction

- In Southern Rome, a 150,000 sqm scheme across three big-box buildings, to be delivered between the end of 2026 and 2028. Occupiers will benefit from its connectivity to the A1 highway, making it convenient to serve Rome as well as Southern Italy

- In Greater Bologna, a 33,000 sqm property, which is expected to be delivered by H1 2027. The asset benefits from immediate access to A1 highway.

All of the assets will be developed to the highest Grade-A standards and are set to achieve at least a “LEED Gold” ESG certification.

These transactions follow the JV’s initial investments in Bari and Tuscany, where the JV has recently delivered two LEED-gold certified logistics schemes totaling 110,000 sqm.

Rafael Coste Campos, a Partner at Bain Capital, said: “We maintain a positive outlook on European logistics and, across the locations where we are present, are well positioned to benefit from the current market tailwinds. We see a solid demand outlook, fostered by secular themes of e-commerce penetration and nearshoring, a reduced pipeline of modern, Grade-A product, whilst witnessing increasing quality requirements from tenants. All this is contributing to contained vacancy and growing rents. Our European Grade-A logistics portfolio has reached a critical mass of $1.5 billion GDV today, and we are looking to expand further. This investment marks a significant milestone in our strategy and further strengthens our long-term partnership with Stoneweg.”

Joaquin Castellvi, Co-Founder and Head of Strategic Investments at Stoneweg commented: “The Italian logistics sector continues to be characterized by sub-5% vacancy levels and has been a top performer in 2025, with investment activity up 121% year on year, underlining the sector’s defensive characteristics despite the uncertain global economic backdrop. Driven by demand from the renewable energy, luxury maritime and e-commerce logistics segments, and supported by Italy’s favourable GDP and employment outlook, we anticipate strong occupier demand for these highly sustainable assets. Alongside Bain Capital, and leveraging the strength of our local teams, as well as the opportunities being presented by current market dislocation, we have the ambition and near-term pipeline to significantly scale the platform.”

LikeDiscussion

Share

Discussion

You are commenting on Bain Capital and Stoneweg to expand Italian logistics development JV with €200 million investment

You must be logged in to add a comment

There are no comments

Be the first to add to the discussion

Fund manager

Bain Capital

Boston, United StatesWe are one of the world’s leading private investment firms with approximately $185 billion in assets under management as of March 31, 2025, that creates lasting impact for our investors, teams, businesses and the communities in which we live. Founded in 1984, we pioneered a consulting-based approach to private equity investing, partnering closely with management teams to offer the insights that challenge conventional thinking, build great businesses and improve operations. Over time, we have organically expanded this approach across asset classes to build one of the strongest alternative asset platforms in the world.

buyoutprivate equityprivate debtspecial situations

Related news

Blackstone and Lunate Announce Strategic Partnership to Invest in GCC Logistics

Bain Capital and Oliver Street Capital Acquire 11-Property Infill Industrial Portfolio in Northern New Jersey

Bain Capital Announces Strategic €150 Million Investment in Företagsparken, a Leading Swedish Light Industrial Property Company

I Squared Capital Appoints Philippe Lenoble and Bogdan Ciobotaru as Managing Directors

Equitix Partnership Confirmed For Construction Of Greenfield Renewable Energy Project, Sweden

Trackunit, a Global Leader in Software and IoT Connectivity Solutions for the Construction Sector, Announces Investment from Goldman Sachs Alternatives

Green Arrow Capital and L&L Group sell a portfolio of 5 biomethane plants to Verdalia Bioenergy

Green Arrow Capital and Lazzari&Lucchini enter into an agreement for the sale of Biomethane plants to Verdalia Bioenergy